Raising Capital and Payout Policy

Created by David Moore, PhD

Reference Material: Chapter 15 and 17 of TextbookTopics

- Life cycle of firm

- How it raises capital, specifically equity

- Process of going public: IPO

- Issues and costs

- Dividends and Share Repurchases

- Methods

- Costs and Benefits

- Stock Dividends and Stock Splits

Venture Capital

Intro to VC

- Done be individual investors, angel investor, venture capital firms, other investment firms.

- Usually involves active participation by VC

- Ultimate goal: take company public; the VC will benefit from the capital raised in the IPO

- Hard to find and expensive

Stage Financing

- Funding provided in several stages

- Contingent upon specified goals at each stage

- First stage

- "Ground floor" or "Seed money"

- Fund prototype and manufacturing plan

- Second Stage

- "Mezzanine" financing

- Begin manufacturing, marketing, and distribution

More about VC financing

- Rounds following seed are labeled Series A,B,C, etc

- Funding follows life cycle of start-up

- Seed: Initial idea A: Optimizing B:Build C: Scale

Fun fact: Unicorn refers to startup's valued at $1 Billion

Example: Uber

Example: Zwift

Choosing a Venture Capitalist

Need to consider:

- Financial strength

- Compatible management style

- Obtain and check references

- Contacts

- Exit strategy

Bad Blood

Book: Bad Blood: Secrets and Lies in a Silicon Valley Startup.- 2003 Start-up health technology company: founder Elizabeth Holmes

- Seed money: $\$$6 million at $\$$34 million valuation

- By 2010: Series B and C: $\$$45 million at $\$$1 billion valuation

- Estimated Valuation $\$$9 billion ($\$$810 million VC raised)

- Company found fraudulent and ceased operations in 2018

- Holmes Net worth 4.5 Billion to 0

- Major investors (Walton family:150M; Murdoch:121M; Betsy DeVos:100M; Cox family:100M)- now worthless.

- Holmes currently facing criminal charges (wire fraud)

Selling Securities to the Public

Timeline

- Management obtains permission from the Board of Directors

- Firm files a registration statement with the SEC (discloses all material information)

- SEC examines the registration during a 20-day waiting period

- Securities may not be sold during the waiting period

Timeline, cont'd

- A preliminary prospectus, called a red herring, is distributed during the waiting period

- If problems, the company amends the registration, and the waiting period starts over

- Price per share determined on the effective date of the registration and the selling effort begins

- A final prospectus must accompany delivery of securities or confirmation of sale.

Prospectus

YETI

Lyft

Issue Methods

- Public Issue

- Registration with SEC required

- General cash offer = offered to general public

- Rights offer = offered only to current shareholders

- IPO = Initial Public Offering = Unseasoned new issue

- SEO = Seasoned Equity Offering

- Private Issue

- Sold to fewer than 35 investors

- SEC registration not required

Note on Crowdfunding

- Limits on equity raised and investments

- Can only issue $\$$1 million in equity per 12 months

- Investors will be permitted to invest up to $\$$100,000 in crowdfunding issues per 12 months

- Most "crowdfunding" you think of (Kickstarter) does not involve equity.

Special Purpose Acquisition Company (SPAC)

- AKA: "Blank Check Companies"

- 2019: 59; 2020: 248; 2021 Q1: 296

- No business or operation

- Formed with sole purpose of acquisition

- Funds raised through IPO must be used for acquisition

- Typically must return funds to investors if no acquisition after 2 years.

A great discussion of SPACs by Matt Levine

Underwriting

Underwriters

Provide the following services:

- Formulate method to issue securities

- Price the securities

- Sell the securities

- Price stabilization by lead underwriter in the aftermarket

Note: Firms can choose to do a direct listing.

Underwriter Terms

- Syndicate = group of investment bankers that market the securities and share the risk associated with selling the issue

- Spread = difference between what the syndicate pays the company and what the security sells for in the market. (direct cost/fee of IPO)

Tombstone

- Investment banks in syndicate divided into brackets

- Firms listed alphabetically within each bracket

- "Pecking order": higher bracket = greater percentage

- Underwriting success built on reputation

Tombstone Example

Types of Underwriting

- Firm Commitment

- Best Efforts

- Dutch Auction

Firm Commitment Underwriting

- Issuer sells entire issue to underwriting syndicate

- Syndicate resells issue to the public

- Underwriter makes money on the spread between the price paid to the issuer and the price received from investors when the stock is sold

- Syndicate bears the risk of not being able to sell the entire issue for more than the cost

- Most common type of underwriting in the United States

More on Firm Commitment

- Underwriters meet with potential buyers to determine offering price

- Road show: pitch stock in multiple cities

- Bookbuilding: Process of soliciting information about buyers and the prices and quantities they would demand.

Best Efforts Underwriting

- Underwriter makes "best effort" to sell the securities at an agreed-upon offering price

- Issuing company bears the risk of the issue not being sold

- Offer may be pulled if not enough interest at the offer price

- Company does not get the capital and they have still incurred substantial flotation costs (cost of "floating" new issue)

- Not as common as it used to be

Dutch or Uniform Price Auction

- Buyers:

- Bid a price and number of shares

- Seller:

- Work down the list of bidders

- Determine the highest price at which they can sell the desired number of shares

- All successful bidders pay the same price per share.

- Encourages aggressive bidding

Auction Example

The company wants to sell 1,500 shares and receives the following bids:| Bidder | Quantity | Bid |

|---|---|---|

| A | 500 | $20 |

| B | 400 | 18 |

| C | 250 | 16 |

| D | 350 | 15 |

| E | 200 | 12 |

The firm will sell 1,500 shares at $15 per share.

Bidders A, B, C, and D will get shares.

Other Terms

Aftermarket

Green Shoe Provision

- "Overallotment Option"

- Allows syndicate to purchase an additional 15% of the issue from the issuer

- Allows the issue to be oversubscribed

- Provides some protection for the lead underwriter as they perform their price stabilization function

- In all IPO and SEO offerings but not in ordinary debt offerings

Lockup Agreements

- Not legally required but common

- Restricts insiders from selling IPO shares for a specified time period

- Common lockup period = 180 days

- Stock price tends to drop when the lockup period expires due to market anticipation of additional shares hitting the Street

Quiet Period

- From initial contemplation of IPO to 40 days after the IPO

- No non-ordinary announcements may be made

- All relevant information about firm should be in prospectus

- Fun fact: Google's IPO almost delayed due Brin and Page interview appearing in Playboy

IPOs and Underpricing

What is underpricing?

- IPO pricing = very difficult

- No current market price available

- Dutch Auctions designed to eliminate first day IPO price "pop"

- Underpricing causes the issuer to "leave money on the table"

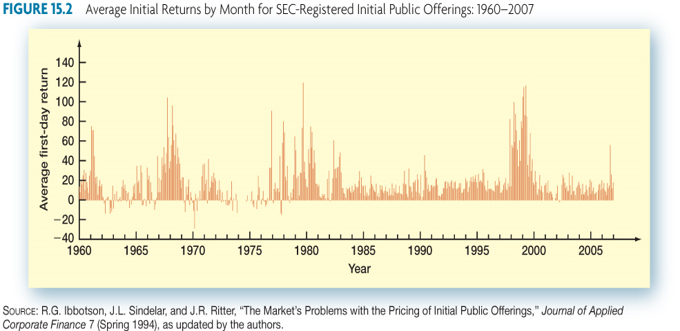

- Degree of underpricing varies over time

How severe is IPO underpricing?

IPO Underpricing Reasons

- Underwriters want offerings to sell out

- Reputation for successful IPOs is critical

- Underpricing = insurance for underwriters

- "Winner's Curse"

- Smaller, riskier IPOs underprice to attract investors

Seasoned Equity Offering (SEO)

- Stock prices tend to decline when new equity is issued

- Signaling explanation

- Equity overvalued: If management believes equity is overvalued, they would choose to issue stock shares.

- Debt usage: Issuing stock may indicate firm has too much debt and can not issue more debt

- Issue costs for equity – direct and indirect - are significantly more than for debt

Costs of Issuing Securities

- Gross spread: direct fees paid

- Other direct expenses: filing fees, legal fees, taxes

- Indirect expenses: Cost of managements time

- Abnormal returns: Related to SEO price drop

- Underpricing: loss from selling below true value

- Green shoe option: selling additional shares at offer price

Cost Statistics

- Total direct costs ≈ 10.4%

- Direct costs very large, especially for issues < $\$$10 million (25.22%)

- Underpricing cost ≈ 19.3%

- Average spread = 7%

- Patterns:

- Substantial economies of scale

- Costs of selling debt < issuing equity

- IPO costs > SEO costs

IPO Examples

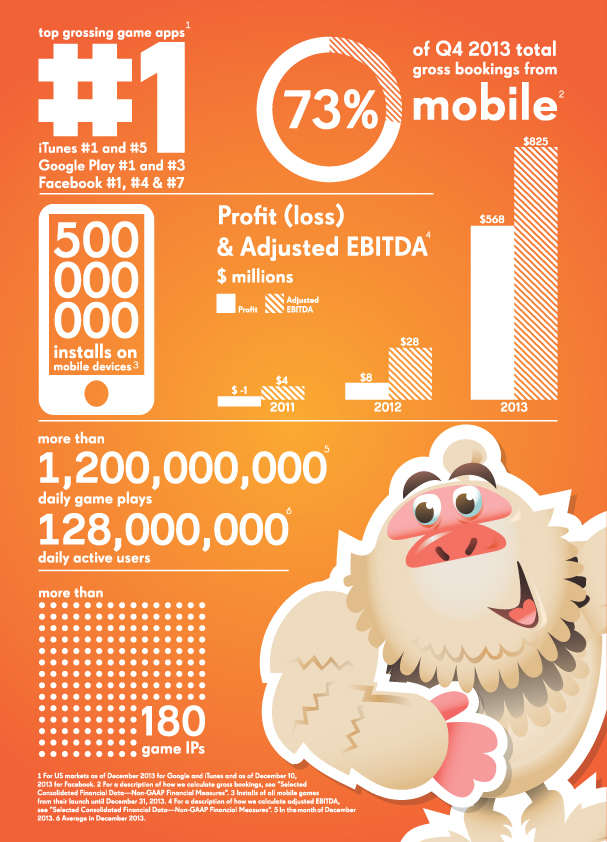

King Entertainment "Candy Crush" IPO

King Entertainment "Candy Crush" IPO

- Received $\$$84 Million in VC financing (2 rounds)

- Issue preliminary prospectus: 2/2014

- Initial price range: $\$$21-24 a share

- Revised price range: none

Twitter IPO

Twitter IPO

- Received $\$$15 Billion in VC financing (13 rounds)

- Issue preliminary prospectus: 10/2013

- Initial price range: $\$$17-20 a share

- Revised price range: $\$$23-25

King Entertainment "Candy Crush" IPO

- King is issuing 7% of its stock

- 70% offered by company

- 30% offered by VC investors

- Funds raised: $\$$350M

- Market cap will be $7 billion

Twitter IPO

- Twitter is issuing 15% of its stock

- Funds raised: $\$$2 billion

- Market cap will be $\$$13.6 billion

- Currently unprofitable

King Entertainment "Candy Crush" IPO

- King priced at $22.5/share

- Spread was $1.29/share or 5.73%

- King raised $21.21/share

- First trade took place at 9:55am on 11/7/2013

- $\$$20.50 (closed at $\$$19.70 a share)

- Down 12.5% from IPO price

- Acquired by Activision in 2016 for $\$$18 a share

Twitter IPO

- Twitter priced at $\$$26/share

- Spread was $\$$0.845/share or 3.25%

- Twitter raised $\$$25.155/share

- First trade took place at 10:50am 11/7/2013

- $\$$45.10/share (closed at $\$$44.90)

- Up 75.69% from IPO price

- Assuming green shoe, TWTR will sell 80.5MM shares

- Left $\$$1.6 billion on the table

- Current price: $\$$71.25

Example Problems

Shares Needed

Nu Tech wants to raise $\$$21 million to purchase equipment by issuing new securities. Management estimates the issue will cost the firm $\$$320,000 for accounting, legal, and other costs. The underwriting spread is 7.5 percent and the issue price is $\$$21 per share. How many shares of stock must be sold if Nu Tech is to receive sufficient funds to purchase all the desired equipment?Flotation Costs

Entertainment 720 Inc went public under a firm commitment agreement. The company received $\$$32.75 for each of the 15 million shares sold. The offer price was set at $\$$36 per share and stock rose to $\$$39.74 on the first day of trading. Direct costs were $\$$1.2 million and indirect costs were $\$$520,000 What was the spread? What was the flotation cost as a percentage of funds raised?Raising Capital: Not covered

- Rights

- Dilution

- Issuing Long-term Debt

Dividends

Cash Dividends

- Regular cash dividend: cash payments made directly to stockholders, usually each quarter

- Special cash dividend: one-time event with no expectation of being repeated

- Liquidating dividend: some or all of the business has been sold

Dividend Payment Chronology

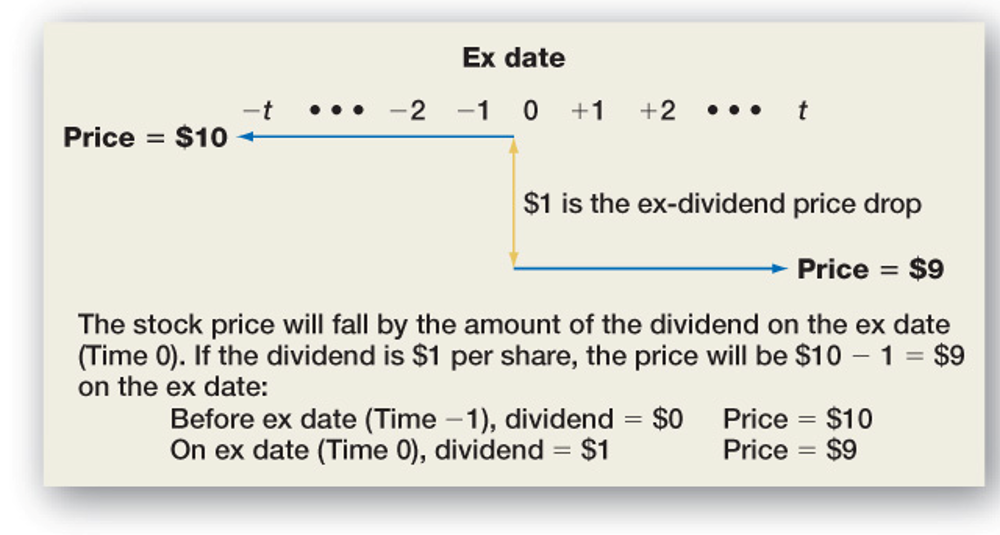

- Declaration Date: Board declares the dividend and it becomes a liability of the firm

- Ex-dividend Date

- Occurs two business days before date of record

- If you buy stock on or after this date, you will not receive the upcoming dividend

- Stock price generally drops by approximately the amount of the dividend

- Date of Record: holders of record are determined, and they will receive the dividend payment

- Date of Payment: checks are mailed (funds are transferred)

The Ex-Dividend Day Price Drop

Example

Factors Favoring a Low Payout

- Taxes

- Individuals in upper income tax brackets might prefer lower dividend payouts, with their immediate tax consequences, in favor of higher capital gains

- Flotation costs

- Low payouts can decrease the amount of capital that needs to be raised, thereby lowering flotation costs

- Dividend restrictions

- Debt covenants may limit the percentage of income that can be paid out as dividends

Factors Favoring a High Payout

- Desire for current income

- Individuals in low tax brackets

- Groups that are prohibited from spending principal (trusts and endowments)

- Uncertainty resolution

- No guarantee that the higher future dividends will materialize

- Taxes

- Dividend exclusion for corporations (70%)

- Dividends versus capital gains irrelevant to tax-exempt investors

Clientele Effect

Share Repurchases (Stock Buybacks)

What is a buyback

- Comparison to Dividends

- Repurchases returns cash from the firm to the stockholders

- Same as cash dividend in the absence of taxes and transactions costs

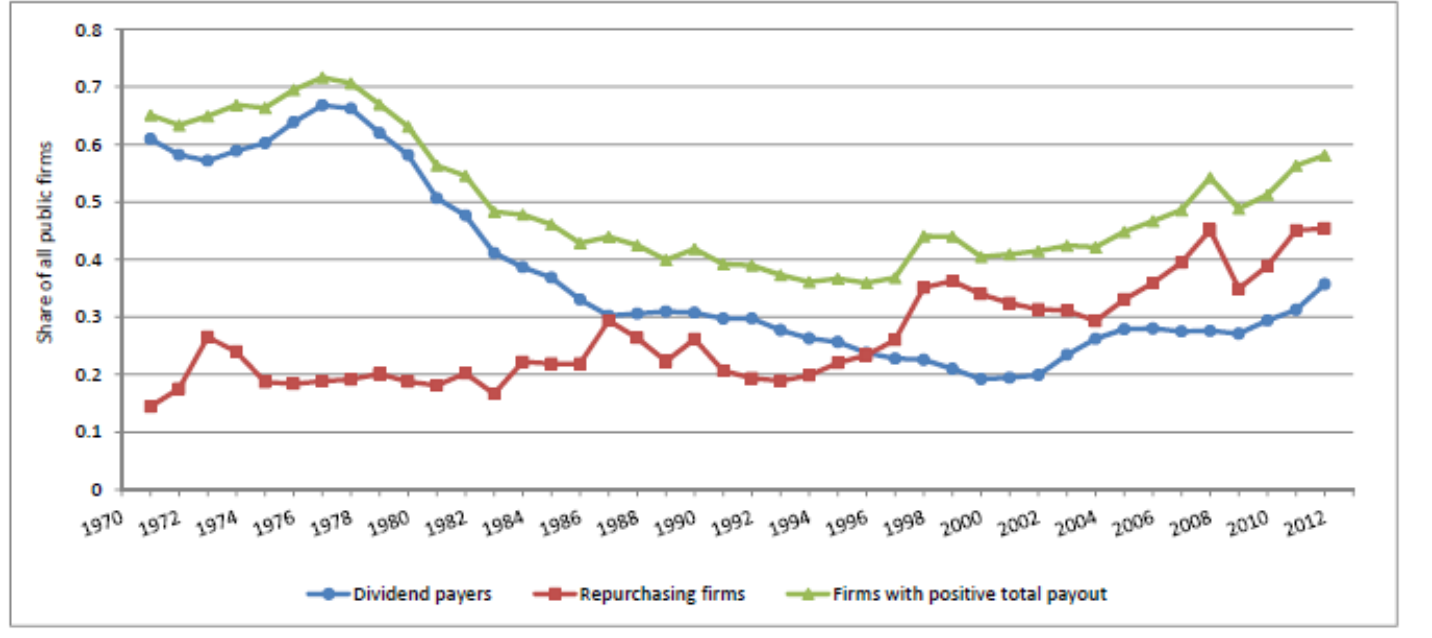

Payout Choice 1970-2014

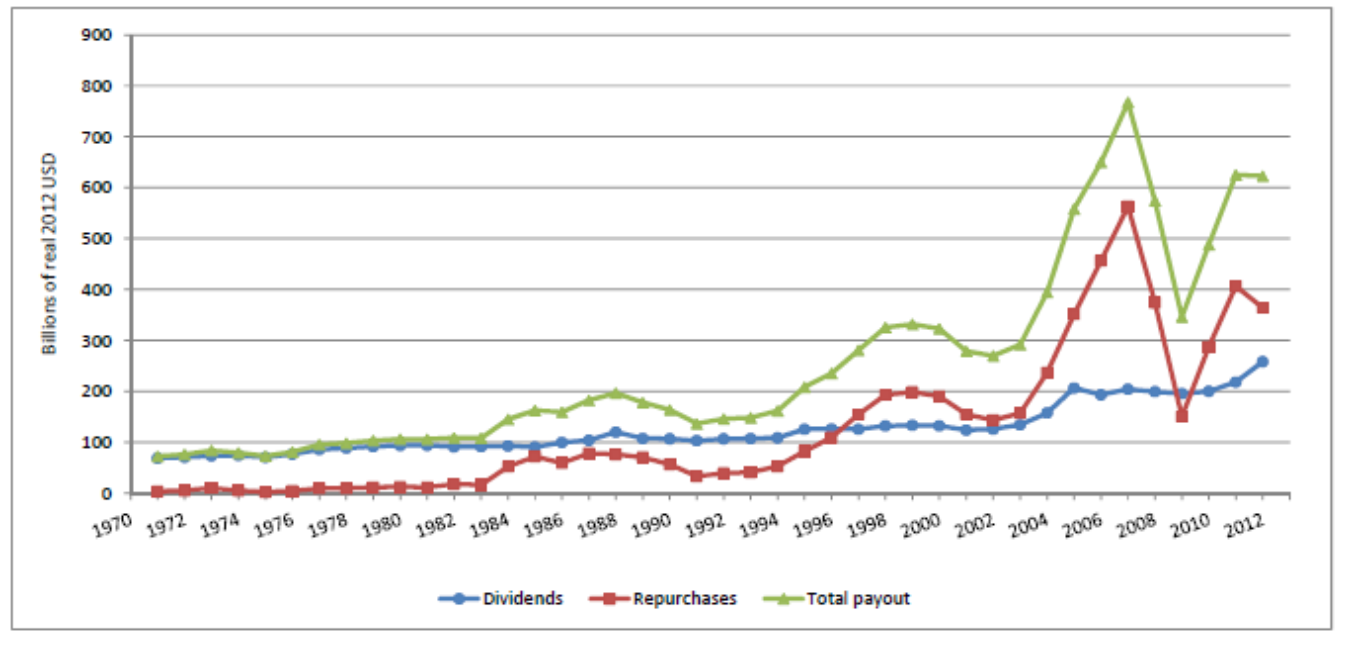

Payout Policy 1970-2014: Dollars Spent

Repurchase Methods

- Open market repurchase (OMR) = company buys its own stock in the open market (most common)

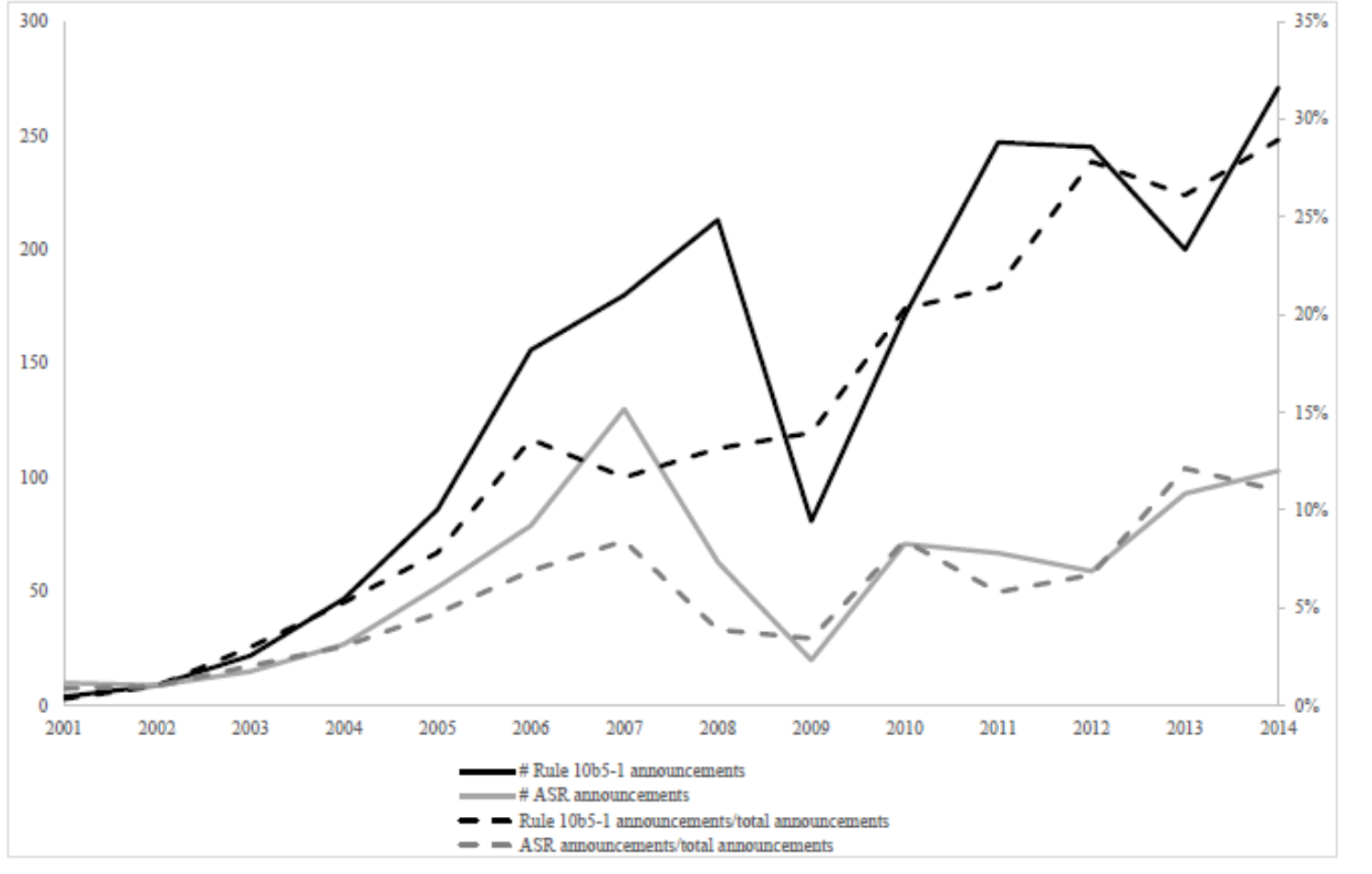

- Rule 10b5-1 Preset Repurchase = firms set up a preset plan to repurchase shares (becoming more common 20-30%)

- Accelerated share repurchase(ASR) = firms buy back shares immediately from an investment back (gets shares immediately)

- Tender offer = company states a purchase price and a desired number of shares to be bought (becoming less common)

- Targeted repurchase or Privately negotiated = firm repurchases shares from specific individual shareholders

Preset and Accelerated Repurchases

Taxes

- Reminder: Cash Dividends

- No investor control over timing or size

- Taxed as ordinary income (if ordinary)

- Repurchases:

- Allows investors to decide if they want a current cash flow

- Taxed only if:

- They choose to sell AND

- They reap a capital gain on the sale

- Gain may qualify as lower taxed capital gains if shares owned more than one year.

Repurchase Motivations

- Undervaluation: management believes stock price is too low, buying back shares is good investment

- Free cash flow: a repurchase signals that management may not have any good investment and is returning excess capital to shareholders

- Dilution: options cause dilution (increase in shares outstanding) and repurchases help reverse this

- EPS motivated(management incentive): can use a repurchase to meet analyst earnings expectations by decreasing shares outstanding

- Takeover defense: repurchases increase the price at which an acquirer must pay

Repurchase Announcement Example

Apple

On May 1, 2018, the Company announced the Board of Directors had authorized a new program to repurchase up to $100 billion of the Company's common stock. The remaining $\$$9.6 billion repurchased during the third quarter of 2018 was in connection with the new share repurchase program. The Company's new share repurchase program does not obligate it to acquire any specific number of shares. Under this program, shares may be repurchased in privately negotiated and/or open market transactions, including under plans complying with Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the "Exchange Act").

Dividend Announcement Example

Apple

On May 1, 2018, the Company also announced the Board of Directors raised the Company's quarterly cash dividend from 0.63 to 0.73 per share, beginning with the dividend paid during the third quarter of 2018. The Company intends to increase its dividend on an annual basis, subject to declaration by the Board of Directors. The Company plans to use current cash and cash generated from ongoing operating activities to fund its share repurchase program and quarterly cash dividend.

Payout Facts and Figures

- Aggregate dividend and stock repurchases are massive and have increased steadily.

- Dividends heavily concentrated among a small number of large firms.

- Managers very reluctant to cut dividends. (Dividends are "sticky"

- Managers smooth dividends, raising them slowly as earnings grow.

- Stock prices react to unanticipated changes in dividends and to repurchase announcements

- Repurchases are much more flexible than dividends, main reason managers prefer repurchases over dividends

- Average completion rate of repurchases around 80%

Information Content

- Changes in the dividend signal management's view concerning the firm's future prospects

- Stock repurchases signal that management believes the current stock price is low or distributing excess capital

- ASRs, and 10b5-1s send a more positive signal than open market repurchases because the company is increasing commitment to follow through

- Positive market reaction to repurchase announcement, increasing in level of commitment

Pros and Cons: Dividends

- Pros

- Cash dividends underscore good results and provide support to stock price

- Dividends may attract institutional investors

- Stock price usually increases with a new or increased dividend

- Dividends absorb excess cash and may reduce agency costs

- Cons

- Dividends are taxed to recipients

- Inflexible: Dividends can reduce internal sources of funding

- May force firm to forgo positive NPV project

- May require external financing

- Sticky: once established, dividends cuts are hard to make without adversely affecting a firm’s stock price.

Pros and Cons: Repurchases

- Pros

- More flexible relative to dividends

- Can help meet EPS and undue dilution

- Stock price usually increases with an announced program

- Repurchases absorb excess cash and may reduce agency costs

- Cons

- Less of a commitment signal relative to dividends

- Can be used to meet executive compensation goals

- Companies are bad "timers"

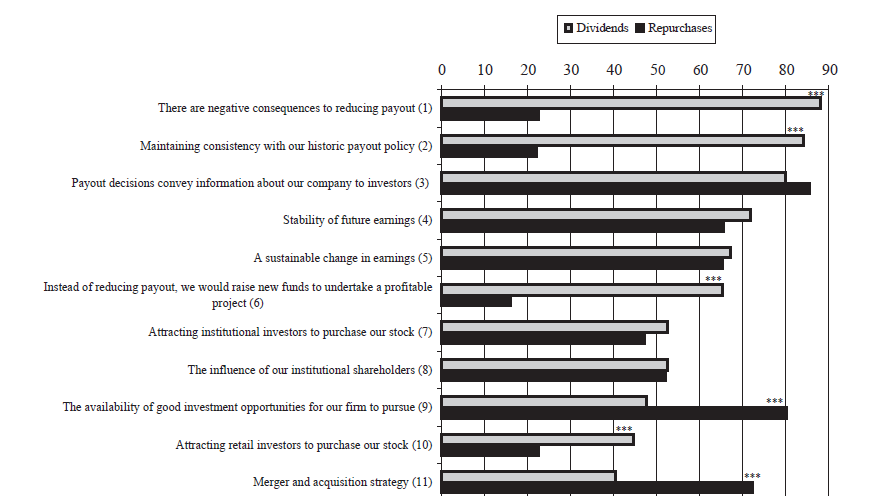

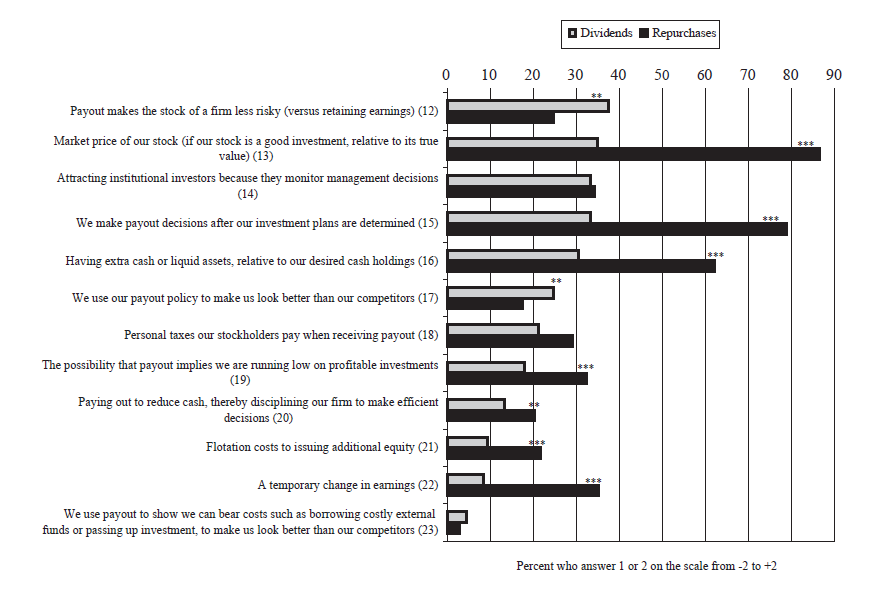

What Do Manager's Say?

What Do Manager's Say?

Stock Dividends and Splits

Stock Dividends

- Distribute additional shares of stock instead of cash (does not change owner's equity)

- Increases the number of outstanding shares

- Small stock dividend: Less than 20 to 25%

- If you own 100 shares and the company declared a 10% stock dividend, you would receive an additional 10 shares

- Large stock dividend: more than 20 to 25%

Stock Split

- Essentially the same as a stock dividend except expressed as a ratio

- For example, a 2-for-1 stock split is the same as a 100% stock dividend

- Stock price is reduced when the stock splits

- Common explanation for split is to return price to a "more desirable trading range"

Reverse Stock Splits

- Reverse Split reduces number of shares outstanding and increase the share price.

- For example, a 1-for-5 stock split replaces every 5 shares of stock with one share

- Motives:

- Transactions costs may be less for investors

- Liquidity might be improved

- Too low a price not considered "respectable"

- Exchange minimum price per share requirements

Example Problems

Example 1: Dividend vs Repurchase

Entertainment 720 Inc. has a market value of equity of $\$$1,000,000, excess cash of $\$$300,000, and net income of $\$$49,000. There are 100,000 shares outstanding.- What is the current stock price, EPS, and P/E ratio?

- What if the excess cash is used to pay a dividend. What is the stock price, EPS, P/E ratio, and Shareholder wealth (per share)? Ignore all frictions, taxes, and imperfections.

- What if the excess cash is used to repurchase shares. What is the stock price, EPS, P/E ratio, and Shareholder wealth (per share)? Ignore all frictions, taxes, and imperfections.

Example 2: Stock Dividends and Splits

Best Bikes Buddy Co. (BBB) currently has 325,000 shares outstanding that sell for $\$$28 each. What will the share outstanding and stock price be if the following occur: (Ignore all frictions, taxes, and imperfections.)- 2 for 1 stock split

- 7 for 5 stock split

- 30% stock dividend

- 2 for 3 reverse stock split

Key Learning Outcomes

- Venture Capital

- Selling Securities to the Public

- IPOs and SEOs

- Timeline

- Underwriters

- Underpricing

- Terminology

Key Learning Outcomes

- Dividends

- Types and chronology

- Low vs high payout factors

- Clientele effect

- Repurchases

- Trends

- Methods and Motives

- Tax effects

- Payout Facts

- Information content, signaling, and market reactions

- Stock dividends and splits