Stock Valuation

Created by David Moore, PhD

Reference Material: Chapter 8 of TextbookTopics

- Stock Valuation

- Intrinsic: Dividend Growth Model

- Relative: Using Multiples

- Features of Common and Preferred stock

- Stock Markets

Stock Valuation: Developing the Model

Cash Flow to Stockholders

- If you own a share of stock, you can receive cash in two ways

- The company pays dividends

- You sell your shares, either to another investor in the market or back to the company

One Period Example

Suppose you are thinking of purchasing the stock of Richie Medical Devices, Inc.- You expect it to pay a $2 dividend in one year

- You believe you can sell the stock for $14 at that time.

- You require a return of 20% on investments of this risk

One Period Price

$D_1=2$

$R=20\%$

$P_1=14$

$CF_1=16$

Compute present value of expected cash flows:

$P_0=\frac{2+14}{1.20}=\frac{16}{1.20}=13.33$

Two Period Price

What if you decide to hold the stock for two years? Assume the price and dividend grows at 5%.$D_1=2$ $D_2=2.10$

$P_2=14.70$

$CF_1=2$ $CF_2=16.80$

Compute present value of expected cash flows:

$P_0=\frac{2}{1.20}+\frac{2.10+14.70}{1.20^2}=13.33$

Three Period Price

What if you decide to hold the stock for three years?$D_1=2$ $D_2=2.10$ $D_3=2.205$

$P_3=15.435$

$CF_1=2$ $CF_2=2.10$ $CF_3=17.640$

Compute present value of expected cash flows:

$P_0=\frac{2}{1.20}+\frac{2.10}{1.20^2}+\frac{2.205+15.435}{1.20^3}=13.33$

Developing The Model

- You could continue to push back when you would sell the stock

- You would find that the price of the stock is really just the present value of all expected future dividends

$\hat{P_0}=\frac{D_1}{(1+r)^1}+\frac{D_2}{(1+r)^2}+\frac{D_3}{(1+r)^3}+...+\frac{D_\infty}{(1+r)^\infty}$

$\hat{P_0}=\sum\limits_{t=1}^\infty \frac{D_t}{(1+r)^t} $

Valuation: Estimating Dividends

Three Special Cases

- Zero Growth

- Firm will pay a constant dividend forever

- Price is computed using the perpetuity formula

- Constant Dividend Growth

- Firm will increase the dividend by a constant percent every period

- Price is computed using the growing perpetuity formula

- Non-Constant Growth

- Dividend growth is not consistent initially, but settles down to constant growth eventually

- Use a combination of TVM techniques

Zero Growth

$P_0=D/r$

Suppose stock is expected to pay a $0.50 dividend every year and the required return is 10%. What is the price? Price = 5

Constant Growth Stock

$D_1=D_0(1+g)^1$

$D_2=D_0(1+g)^2$

$D_3=D_0(1+g)^3$

$D_0=$ Dividend just paid $D_1-D_t=$ Expected dividends

Constant Growth Formula

$\hat{P_0}=D_0\sum\limits_{t=1}^\infty \frac{(1+g)^t}{(1+r)^t}$$=\frac{D_0(1+g)}{r-g}=\frac{D_1}{r-g}$Constant Growth: Example

Suppose Champy's Chicken, Inc. just paid a dividend of $\$$.50. It is expected to increase its dividend by 2% per year. If the market requires a return of 15% on assets of this risk, how much should the stock be selling for?$D_0=0.50$

$g=2%$

$r=15%$

Price = 3.92

Non-Constant Growth

Suppose a firm is expected to increase dividends by 20% in one year and by 15% in two years. After that dividends will increase at a rate of 5% per year indefinitely. If the last dividend was $1 and the required return is 20%, what is the price of the stock?

Non-Constant Growth: Solution

- Compute the dividends until the growth rate levels off.

- Find the expected future price at the beginning of the constant growth period

- Find the present value of the expected future cash flows

Dividend Growth Model

Dividend Growth Model

$\hat{P_t}=\frac{D_{t+1}}{r-g}$

Breaking down DGM

Gordon Growth Company is expected to pay a dividend of $4 next period and dividends are expected to grow at 6% per year. The required return is 16%.- What is the current price?

- What is the price expected to be in year 4?

- What is the implied return given the change in price during the four year period? Notice anything?

Rearranging DGM

$P_0=\frac{D_1}{r-g}$ $r=\frac{D_1}{P_0}+g$

- Required (total) return on a stock has two parts: dividend yield and capital gains yield.

- $\frac{D_1}{P_0}$ is the dividend yield

- Capital gains yield = expected growth rate of the stock price, which matches the dividend growth rate.

Constant Growth Model Conditions

- Dividend expected to grow at g forever

- Stock price expected to grow at g forever

- Expected dividend yield is constant

- Expected capital gains yield is constant and equal to g

- Expected total return, r, must be > g

- Expected total return (r): = expected dividend yield(DY) + expected growth rate (g)

Growth and Payout

- Two conditions must exist if a company is to grow:

- It must invest and not pay out all of its earnings as dividends all the time, and

- It must earn a return on invested capital

- Why don't firms with no dividends have stock price of $0?

- Such firms believe their earnings are better used to pursue growth opportunities; High growth firms tend to have zero or low payout.

- Investors of a zero-dividend firm pay the stock price based on the expected growth rate.

- Expectation is firm will eventually pay a dividend, just not currently paying a dividend

Stock Valuation Using Multiples

Using Multiples: Earnings

- The price-earnings (PE) ratio: the current stock price divided by annual EPS:

- $\text{P/E Ratio}=\frac{Price Per Share}{EPS}$

- In practice, PE ratios are calculated using forecasted EPS or trailing (i.e., past) EPS.

- Using forecasted EPS would lead to forward PE

- In addition to DGM, a common valuation approach is to multiply a benchmark PE ratio by earnings per share (EPS) to come up with a stock price:

- $P_t=\text{Benchmark P/E Ratio * }EPS_t$

Using Multiples: Sales

- Similarly, one can use sales multiples for stock valuation:

Equity Value= Enterprise Value - Net Debt; where Net Debt= Debt-Cash

Using Multiples: Example

Suppose Sloth's are Cool Co. had earnings per share of $\$$3 over the past year. The industry average PE ratio is 12. What is the estimated price per share (today)?$Price = 3 x 12 = 36$

Could you use the following information to estimate the stock price. The comparables median EV/Sales ratio is 1.7. Sales are $350 million and the company has 15 million shares outstanding. Net Debt is $25 million

$Price = \frac{(1.7*350)-25}{15} = 38.00$

Features of Common and Preferred Stock

Common Stock

Common Stock Features:

- Voting rights: generally "one share = one vote"

- Two types of Voting: 1) Straight 2) Cumulative

- Elections are typically staggered

- Proxy voting: grant of authority by a shareholder allowing another individual to vote his or her shares

- Proxy fight: When an "outside" group of shareholders attempt to remove directors/management.

Classes of Stock

- Some firms have multiple classes of stock.

- Typically different share classes have different voting rights

- Example: Berkshire Hathaway Class A and B

Berkshire Hathaway Inc. has two classes of common stock designated Class A and Class B.

Common Stock: other features

- Share proportionally in declared dividends

- Share proportionally in remaining assets during liquidation

- Right to vote on matters of great importance i.e. merger

- Preemptive right (in some cases): Right of first refusal to buy new stock issue to maintain proportional ownership if desired

Preferred Stock

- Dividends:

- Must be paid before dividends can be paid to common stockholders

- Not a liability of the firm

- Can be deferred indefinitely

- Most preferred dividends are cumulative

- Missed preferred dividends have to be paid before common dividends can be paid

- Preferred stock generally does not carry voting rights

- Debt in disguise

The Stock Market

Markets

- Primary: market in which new securities are originally sold to investors. (IPO market)

- Secondary: market in which previously issued securities are traded among investors

Dealer vs Auction (Broker)

- Dealer: maintains an inventory and stands ready to buy and sell at any time.

- Over-the-counter(OTC) markets, ex. NASDAQ or used car dealership

- Auction (Broker): connects buyers to sellers in a physical location. ex. NYSE or real estate broker

Dealer Markets

- Recall bid, ask, and bid-ask spread.

- Analogous to willing to pay, willing to sell, and profit.

- Your bookstore operates like a dealer market (primary and secondary)

Broker Markets

- Arranges transactions; does not buy or sell for their own account.

- Amazon used textbook operates as auction broker market.

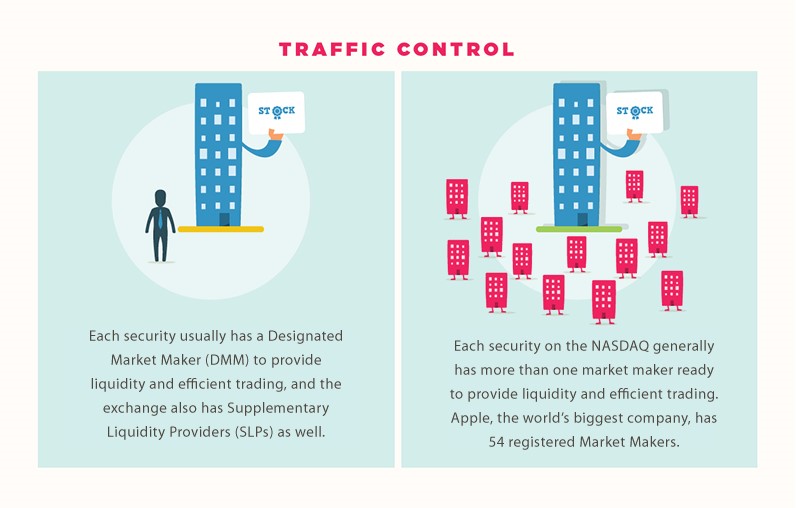

NYSE

- Largest stock market in the world

- Located on Wall Street; auction market

- Most buys and sells are matched electronically nowadays

- Members:

- Designated Market Maker

- Floor Broker

- Supplemental Liquidity Providers

- Order Flow:Flow of customer orders to buy and sell securities

Recent IPOs: Doordash, Uber, Chewy

NASDAQ

- Not a physical exchange – computer-based quotation system

- Market makers act similarly to NYSE DMMs (except there exist multiple market makers for stocks)

- Dealer market

- Large portion of technology stocks

Recent IPOs: Airbnb, Peleton, Smile Direct

More practice

Example 1

Suppose Pirates, Inc. is expected to pay a $\$$2 dividend in one year. If the dividend is expected to grow at 5% per year and the required return is 20%, what is the price? What is the price if the dividend was just $\$$2 with no expectation of growth?Answer: $P_{0}=13.33$; $P_{0}=10.00$

Example 2

XYZ stock currently sells for $\$$50 per share. The next expected annual dividend is $\$$2, and the growth rate is 6%. What is the expected rate of return on this stock?If the required rate of return on this stock were 12%, what would the stock price be, and what would the dividend yield be?

Answer: r=10%; $P_{0}=33.33$; Yield=6%

Example 3

AcheE Corp.'s last dividend was $\$$.65 per share. Its dividends are expected to grow at a rate of 4% and the current price per share is $\$$11.25. What is the discount rate (i.e., cost of capital, required return) implicit in its price?Answer: r=10.01%

Key Learning Outcomes

- Stock Valuation

- Intrinsic: Dividend growth model

- Zero growth

- Constant Growth

- Non-Constant Growth

- Relative: Trading Multiples

- Common and Preferred Stock features

- Stock Market

- Broker or Auction (NYSE) vs Dealer (NASDAQ)