Risk, Return, and Cost of Capital

Created by David Moore, PhD

Reference Material: Chapter 12, 13 and 14 of TextbookTopics

- First Lesson: Average Returns

- Second Lesson: Variability of Returns

- Arithmetic vs Geometric Returns

- Capital Market Efficiency

- Expected Returns and Variances

- Portfolios

- Diversification

- Total, systematic, unsystematic risk

- Beta

- Reward-to-risk Ratio

- Security Market Line and CAPM

- Cost of Capital

Overview: Risk, Return and Financial Markets

- Lessons from capital market history

- There is a reward for bearing risk

- The greater the potential reward, the greater the risk

- This is called the risk-return trade-off

How should we measure risk and return?

First Lesson: Average Return

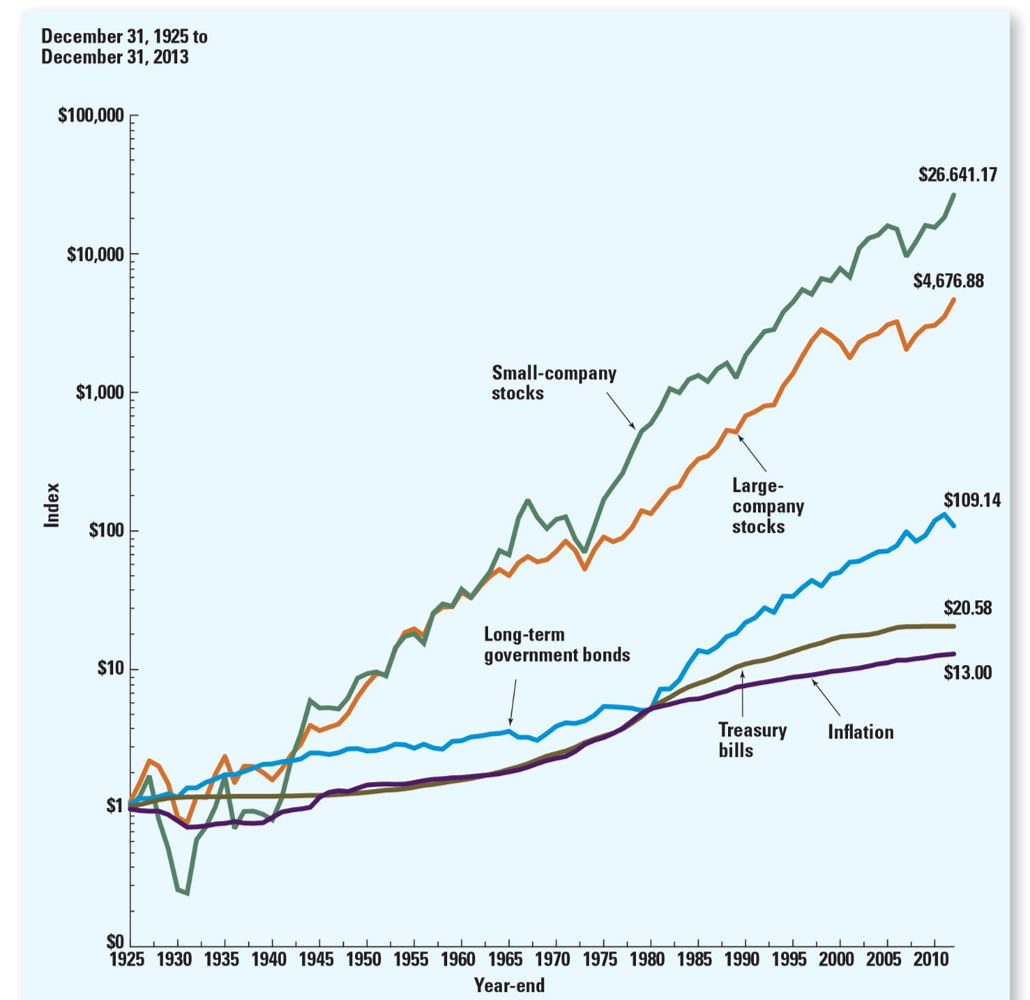

Historical Record

Ranking Returns

- Small cap stocks

- Large cap stocks

- Long-term government bonds

- Treasury Bills

- Inflation

Why wouldn't you just buy small cap stocks?

Calculating Returns

- Total Dollar Return

- $Return = Dividends + Capital Gains

- Total Percent Return

- %Return = $\frac{\$Return}{\$Invested}$

Example: Returns

You just invested in "You call that a Donut! Inc" for $\$$25, after one-year the price is $\$$35. Each share paid out a $\$$2 dividend. What was your total return?| Dollar Return | Percent Return | |

|---|---|---|

| Dividend | 2 | $\frac{2}{25}=8\%$ |

| Capital Gains | 35-25=10 | $\frac{35-25}{25}=40\%$ |

| Total Return | 2+10=12 | $\frac{10+2}{25}=48\%$ |

Percent Returns: Formulas

Dividend Yield$DY=\frac{D_{t+1}}{P_t}$

Capital Gains Yield

$CGY=\frac{P_{t-1}-P_t}{P_t}$

$\%Return=\frac{D_{t+1}+P_{t+1}-P_t}{P_t}$

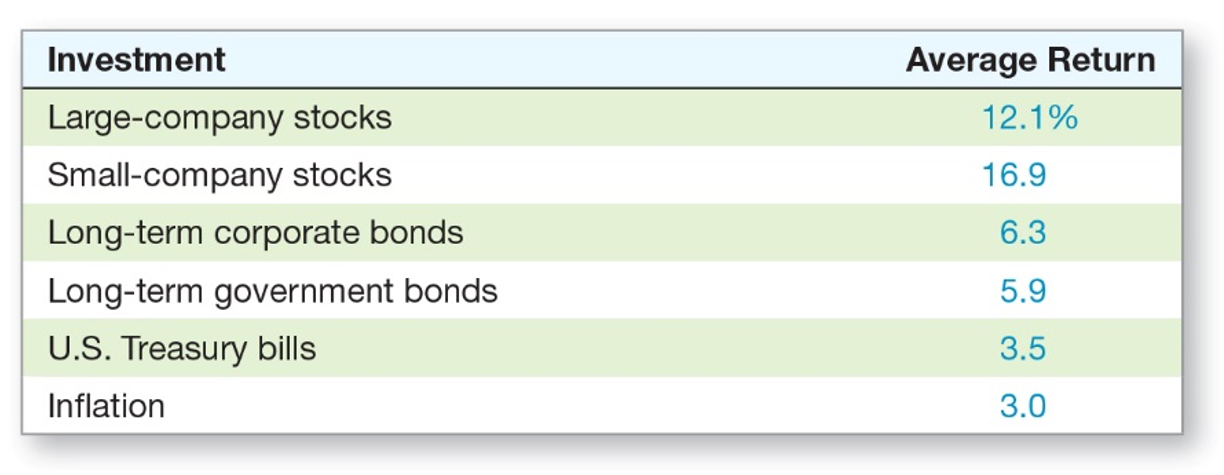

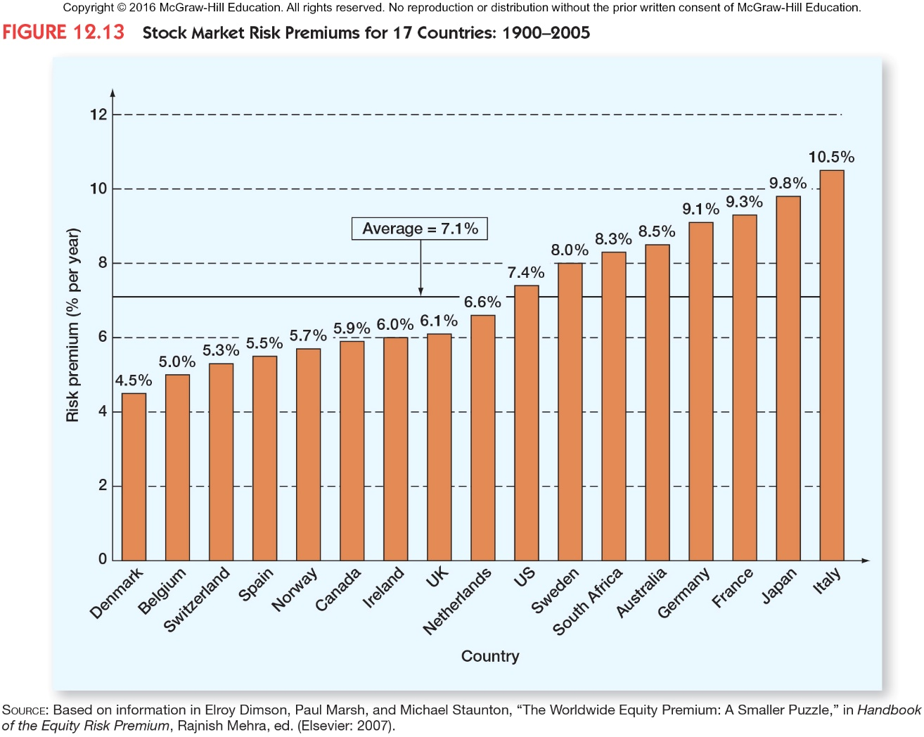

Historical Average Returns

$HistoricalAverageReturn=\frac{\sum\limits_{i=1}^TReturn_i}{T}$

Large cap stocks average return from 1926 to 2010: 12.1%

Your best guess about the size of the return for a year selected at random is 12.1%.

Historical Average Returns: 1926-2010

Practice: Average

Returns: -6, 8, 12, -15, 6Average = 1

Returns: -1, 2, -1, 1, 4

Average = 1

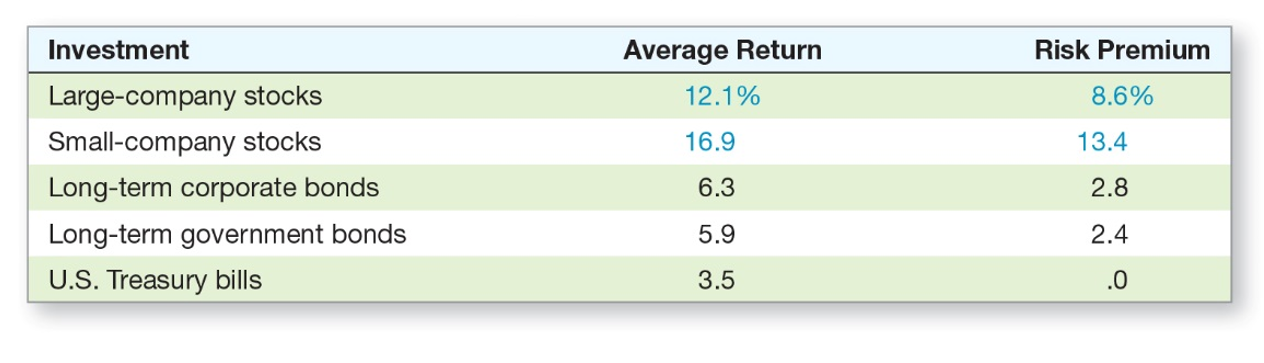

Risk Premium

U.S. Treasury bill is considered risk-free return

Historical Average Risk Premium

First Lesson Takeaways

Large company stocks have a historical average risk premium of 8.6%

What determines size of risk premium?

Second Lesson: Return Variability

Measuring Return Variability

- Variance or $\sigma^2$

- Common measure of return dispersion

- Standard deviation or $\sigma$

- Sometimes called volatility

- Same "units" as the average

Example

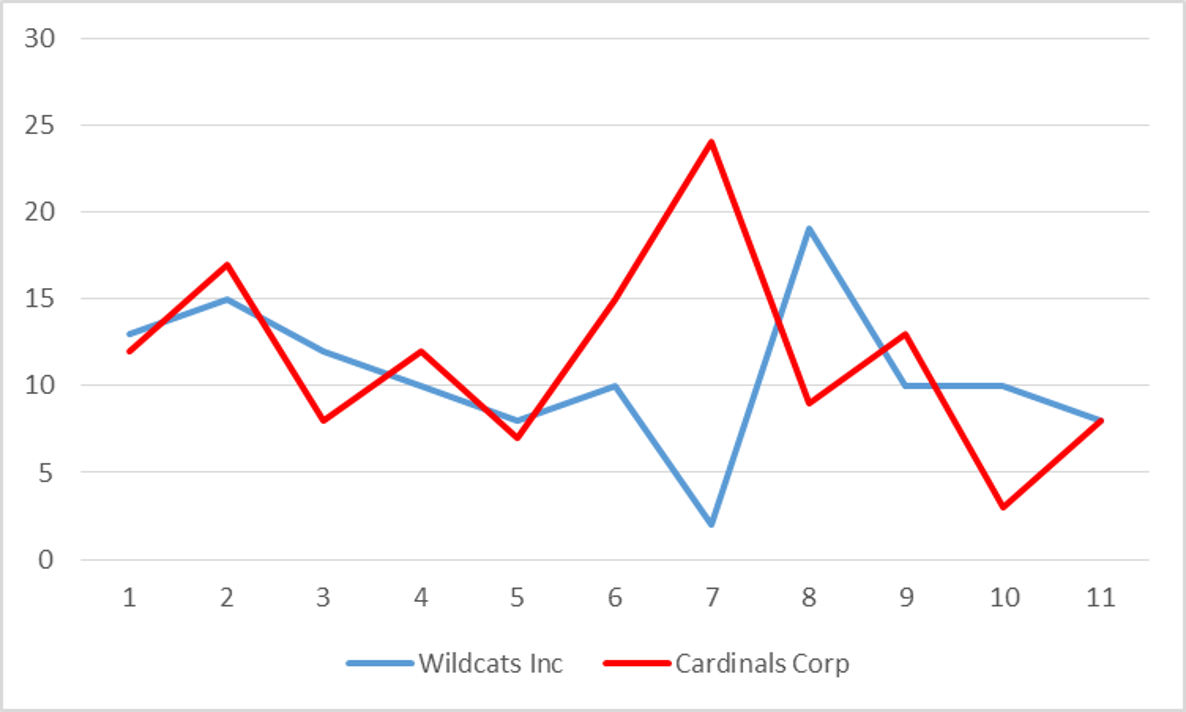

Two companies have the following returns:Wildcat Inc: 13,15,12,10,8,10,2,19,10,10,8

Cardinals Corp: 12,17,8,12,7,15,24,9,13,3,8

| Wildcats Inc. | Cardinals Corp. | |

|---|---|---|

| Average | 10.6 | 11.6 |

| Standard Deviation | 4.3 | 5.7 |

Graphical Representation

Steph vs LeBron (Points in 2016 Playoffs)

Steph Curry (9 games leading into finals):40,29,26,28,24,19,31,31,36.LeBron James (9 games leading into finals):27,24,21,24,23,24,29,23,33.

| Steph | LeBron | |

|---|---|---|

| Average | 29.33 | 25.33 |

| Standard Deviation | 6.25 | 3.71 |

Return Variability

- Return Variance:

$VAR(R)=\sigma^2=\frac{\sum\limits_{i=1}^T(R_i-\bar{R})^2}{T-1}$

- Standard deviation:

$STD(R)=\sigma=\sqrt{VAR(R)}$

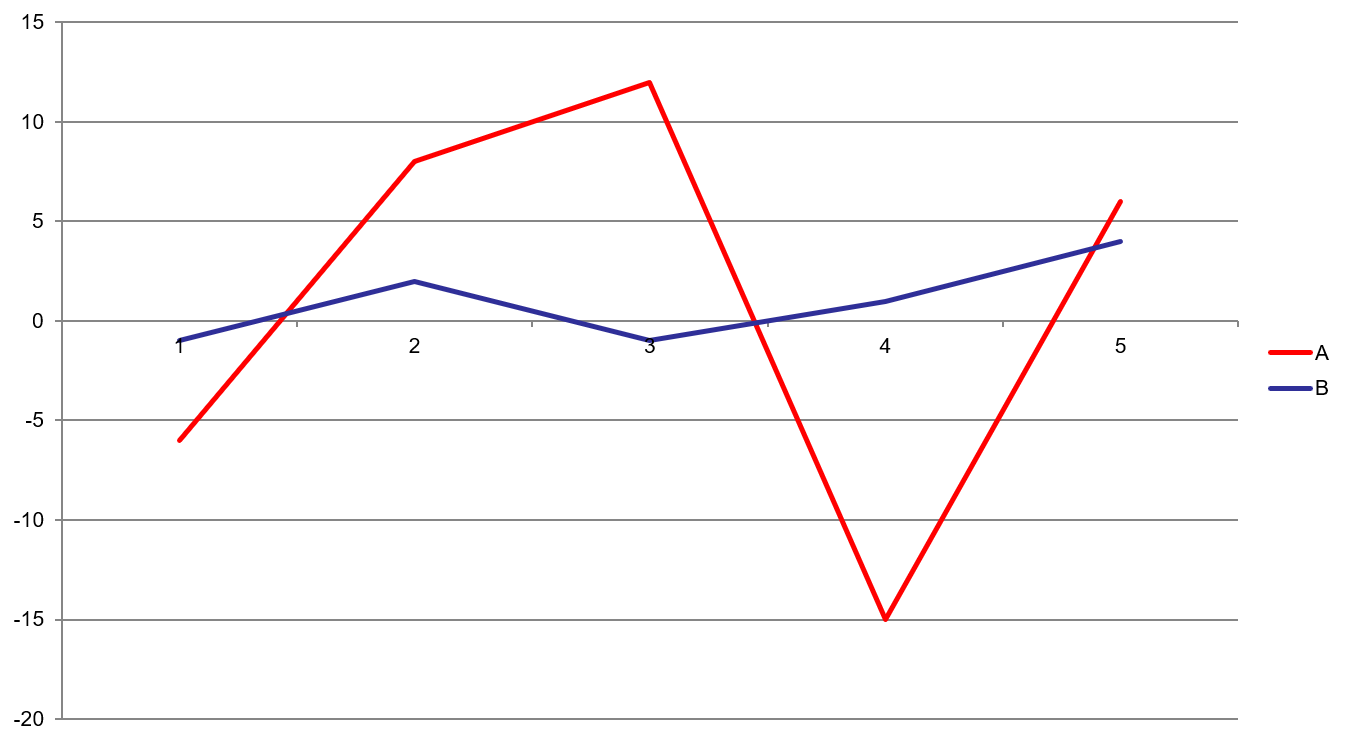

Practice: Standard Deviation

Returns(A): -6, 8, 12, -15, 6Average = 1

Standard deviation = 11.18

Returns(B): -1, 2, -1, 1, 4

Average = 1

Standard deviation = 2.12

Graphing Returns

Example

| Year | Return (%) | Average Return (%) | Difference | Squared Difference |

|---|---|---|---|---|

| 1926 | 11.14 | 11.48 | -.034 | 0.0012 |

| 1927 | 37.13 | 11.48 | 25.65 | 657.82 |

| 1928 | 43.31 | 11.48 | 31.83 | 1013.02 |

| 1929 | -8.91 | 11.48 | -20.39 | 415.83 |

| 1930 | -25.26 | 11.48 | -36.74 | 1349.97 |

| Variance | 859.19 | |||

| Standard Deviation | 29.31 |

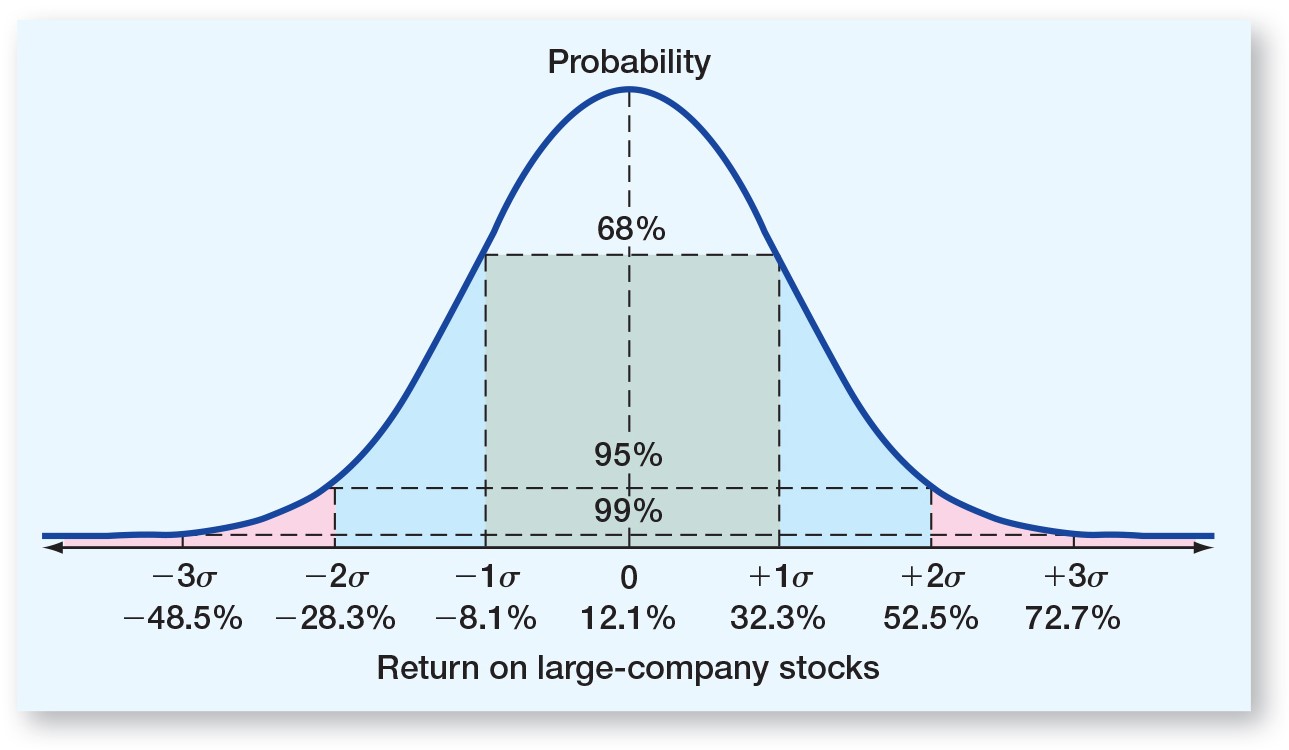

Normal Distribution

Arithmetic vs. Geometric Mean

Think about returns...

If you invest in a hedge fund that loses 20% the first year, but makes 20% the second year, are you back to even?- NO!!!!!

- Start with $\$$100

- After year 1: you have $\$$80

- After year 2, you have $96

Another example

Suppose you invest $\$$100 and it falls 50% in year one but gain 100% in year 2.- Year 0:100

- Year 1:100*(1-0.50)=50

- Year 2:50*(1+1)=100

Arithmetic vs. Geometric Mean

- Arithmetic average:

- Return earned in an average period over multiple periods

- Answers the question: "What was your return in an average year over a particular period?"

- Geometric average

- Average compound return per period over multiple periods

- Answers the question: "What was your average compound return per year over a particular period?"

Geometric average < Arithmetic average unless all the returns are equal

Geometric Average: Formula

$GAR=[(1+R_1)*(1+R_2)*...*(1+R_T)]^{\frac{1}{T}}-1$

Where:

$R_i$= return in each period

$T$ = number of periods

Geometric Average: Formula

$GAR=[\prod\limits_{i=1}^T(1+R_i)]^{\frac{1}{T}}-1$

Where:

$\prod$= Symbol for product (multiply)

$R_i$= return in each period

$T$ = number of periods in sample

Revisit Examples

If you invest in a hedge fund that loses 20% the first year, but makes 20% the second year.Average Return: 0%

Geometric return: -2.02%

Suppose you invest $\$$100 and it falls 50% in year one but gain 100% in year 2.

Average Return: 25%

Geometric Return: 0%

Example

| Year | Return (%) | (1+R) | Compounded |

|---|---|---|---|

| 1926 | 11.14 | 1.114 | 1.114 |

| 1927 | 37.13 | 1.3713 | 1.5241 |

| 1928 | 43.31 | 1.4331 | 2.1841 |

| 1929 | -8.91 | 0.9109 | 1.9895 |

| 1930 | -25.26 | 0.7474 | 1.4870 |

| $(1.4870)^\frac{1}{5}$ | 1.0826 | ||

| Geometric return | 8.26% |

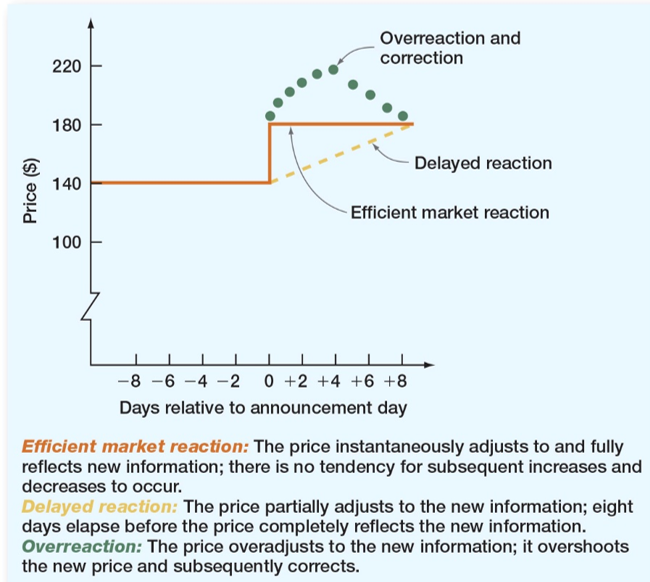

Capital Market Efficiency

Capital Market Efficiency

If true, cannot earn abnormal or excess returns.

Efficient Market Hypothesis

- Idea is competition among investors drives information into prices and thus the market becomes more and more efficient.

- Stocks are all priced correctly

Finance version of "Dad Joke"

A student and a finance professor are walking down the hall when they both see a $\$$20 bill on the ground. The student bends down to pick it up.The professor shakes their head slowly with a look of disappointment. And says…

"Don't bother, If it were really there, someone else would have picked it up already"

Forms of Market Efficiency

- Strong form: all information of every kind is reflected in the stock prices. Including public and private.

- Semi-strong form: all public information is reflected in stock prices.

- Weak form: Prices reflect all past trading information such as prices and volume.

Summary

- No simple way to "beat" the market

- Identifying mispriced stocks is very difficult (borderline impossible)

- Prices do respond rapidly to information

- Very difficult to predict future stock prices

Expected Returns and Variances

Weighted Average Reminder

Your grade is weighted 30% for the midterm 50% for the final. Homework is worth 10% and quizzes another 10%. You did perfect on the homework and quizzes. The midterm you received a 81 and the final was an 92. What is your final grade?Answer: 90.3

Expected Returns

- Expected returns are based on the probabilities of possible outcomes

- In this context, "expected" means average if the process is repeated many times

- The "expected" return does not even have to be a possible return

$E(R)=\sum\limits_{i=1}^Np_iR_i$

Example: E(R)

Suppose you have predicted the following returns for stocks C and T in three possible states of the economy. What are the expected returns?| State | Probability | C | T |

|---|---|---|---|

| Boom | 0.3 | 0.15 | 0.25 |

| Normal | 0.5 | 0.1 | 0.2 |

| Recession | ??? | 0.02 | 0.01 |

| Expected Return | 9.9% | 17.7% |

Variance and Standard Deviation

- Variance and standard deviation measure the volatility of returns

- Using unequal probabilities for the entire range of possibilities

- Weighted average of squared deviations

$\sigma^2=\sum\limits_{i=1}^np_i(R-E(R))^2$

Example

| State | $P_i$ | C | T | $p_i(R_C-E(R))^2$ | $p_i(R_T-E(R))^2$ |

|---|---|---|---|---|---|

| Boom | 0.3 | 0.15 | 0.25 | $0.3(0.15-0.099)^2$ | $0.3(0.25-0.177)^2$ |

| Normal | 0.5 | 0.1 | 0.2 | $0.5(0.1-0.099)^2$ | $0.5(0.2-0.177)^2$ |

| Recession | 0.2 | 0.02 | 0.01 | $0.2(0.02-0.099)^2$ | $0.2(0.01-0.177)^2$ |

| $\sigma^2$ | 0.002029 | 0.007441 | |||

| $\sigma$ | 4.50% | 8.63% |

Portfolios

What is a portfolio?

- A portfolio is a collection of assets

- An asset's risk and return are important in how they affect the risk and return of the portfolio

- The risk-return trade-off for a portfolio is measured by the portfolio expected return and standard deviation, just as with individual assets

Portfolio Weights

Suppose you have $\$$15,000 to invest and you have purchased securities in the following amounts. What are your portfolio weights in each security?| Portfolio | Weights |

|---|---|

| $\$$2000 of DIS | 2/15=13.33% |

| $\$$3000 of KO | 3/15=20% |

| $\$$4000 of AAPL | 4/15=26.7% |

| $\$$6000 of PG | 6/15=40% |

Portfolio Expected Return

$E(R_p)=\sum\limits_{j=1}^mw_jE(R_j)$

- You can also find the expected return by finding the portfolio return in each possible state and computing the expected value as we did with individual securities

Example

| Stock | Weight | Return | $w_jE(R_j)$ |

|---|---|---|---|

| DIS | .1333 | 19.69% | 2.62% |

| KO | .20 | 5.25% | 1.05% |

| AAPL | .267 | 16.65% | 4.45% |

| PG | .40 | 18.24% | 7.30% |

| $E(R_p)$ | 15.41% |

Portfolio Variance

- Compute the portfolio return for each state.

- Compute the expected portfolio return using the same formula as for an individual asset.

- Compute the portfolio variance and standard deviation using the same formulas as for an individual asset.

Example

| State | $P_i$ | A (50%) | B (50%) | $E(R_{p,i})$ | $p_i(E(R_{p,i})-E(R_p))^2$ |

|---|---|---|---|---|---|

| Boom | .4 | 30% | -5% | 12.5% | $.4(12.5-9.5)^2=3.6$ |

| Bust | .6 | -10% | 25% | 7.5% | $.6(7.5-9.5)^2=2.4$ |

| $E(R_j)$ | 6% | 13% | $E(R_p)$9.5% | $\sigma_p^2$=6 | |

| $\sigma_j^2$ | 384 | 216 | $\sigma_p$=2.45% | ||

| $\sigma_j$ | 19.6% | 14.7% |

Note: You CANNOT use stock level $\sigma^2$ and $\sigma$ to calculate portfolio.

Risk, Return, and Diversification

Systematic Risk

- Risk factors that affect a large number of assets

- Also known as non-diversifiable risk or market risk

- Includes such things as changes in GDP, inflation, interest rates, etc.

Unsystematic Risk

- Risk factors that affect a limited number of assets

- Also known as unique risk and asset-specific risk

- Includes such things as labor strikes, part shortages, etc.

Returns

$Total Return = Expected Return + Unexpected Return$$Unexpected Return = Systematic Portion $

$+ Unsystematic Portion$

$Total Return= Expected Return + Systematic Portion$

$+ Unsystematic Portion$

Diversification

- Diversification is not just holding a lot of assets

- For example, if you own 50 Internet stocks, you are not diversified

- However, if you own 50 stocks that span 20 different industries, then you are diversified

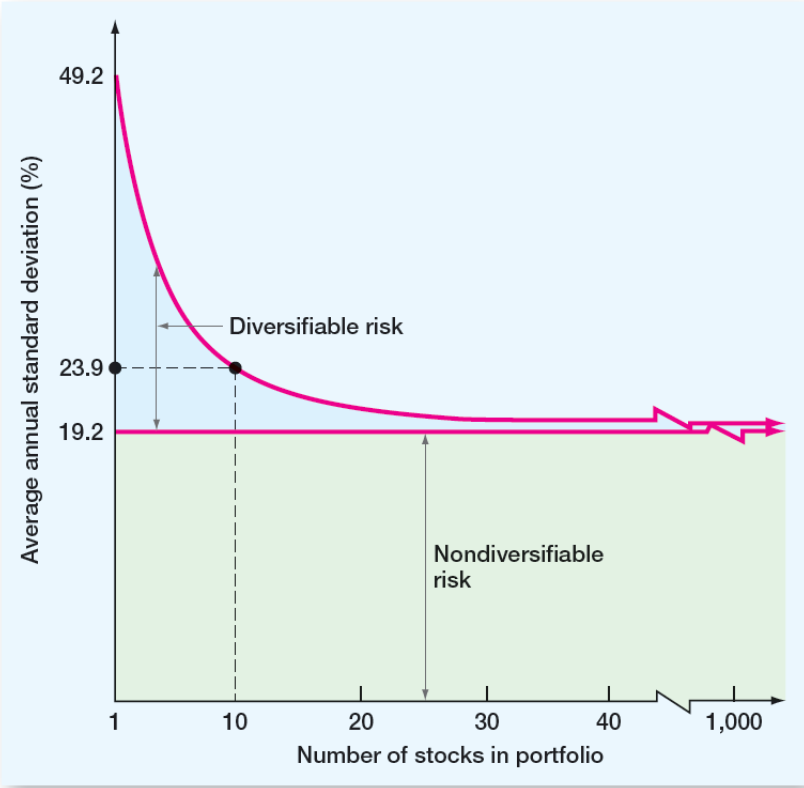

The Principle of Diversification

- Diversification can substantially reduce the variability of returns without an equivalent reduction in expected returns

- This reduction in risk arises because worse than expected returns from one asset are offset by better than expected returns from another

- However, there is a minimum level of risk that cannot be diversified away and that is the systematic portion

Diversifiable vs Non-Diversifiable Risk

Diversifiable Risk

- The risk that can be eliminated by combining assets into a portfolio

- Often considered the same as unsystematic, unique or asset-specific risk

- If we hold only one asset, or assets in the same industry, then we are exposing ourselves to risk that we could diversify away

Total Risk

- The standard deviation of returns is a measure of total risk

- For well-diversified portfolios, unsystematic risk is very small

- Consequently, the total risk for a diversified portfolio is essentially equivalent to the systematic risk

Systematic Risk Principle

Measuring Systematic Risk

- How do we measure systematic risk?

- We use the beta coefficient

- What does beta tell us?

- A beta of 1 implies the asset has the same systematic risk as the overall market

- A beta < 1 implies the asset has less systematic risk than the overall market

- A beta > 1 implies the asset has more systematic risk than the overall market

Current Beta's

Total vs. Systematic Risk

Consider the following information:| Standard Deviation | Beta | |

|---|---|---|

| Marathon Oil | 20% | 3.13 |

| Exxon Mobil | 30% | 0.69 |

- Which security has more total risk? Exxon Mobil

- Which security has more systematic risk? Marathon Oil

- Which security should have the higher expected return? Marathon Oil

Portfolio Beta

Consider the previous example with the following four securities| Security | Weight | Beta |

|---|---|---|

| DIS | .133 | 1.444 |

| KO | .2 | 0.797 |

| AAPl | .267 | 1.472 |

| PG | .4 | 0.647 |

What is the portfolio beta?

.133(1.444) + .2(0.797) + .267(1.472) + .4(0.647) = 1.003

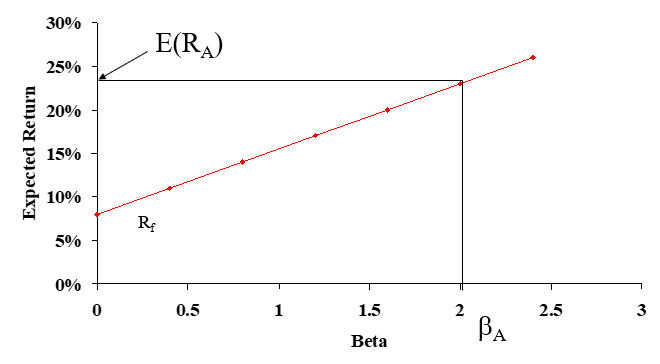

Portfolio Expected Returns and Betas

Reward-to-Risk Ratio

- The reward-to-risk ratio is the slope of the line illustrated in the previous example

- $Slope=\frac{E(R_A)-R_f}{\beta_A-0}$

- From graph, $Slope=\frac{23-8}{2-0}=7.5$

- What if an asset has a reward-to-risk ratio of 8 (implying that the asset plots above the line)?

- What if an asset has a reward-to-risk ratio of 7 (implying that the asset plots below the line)?

Market Equilibrium

$\frac{E(R_A)-R_f}{\beta_A}=\frac{E(R_M)-R_f}{\beta_M}$

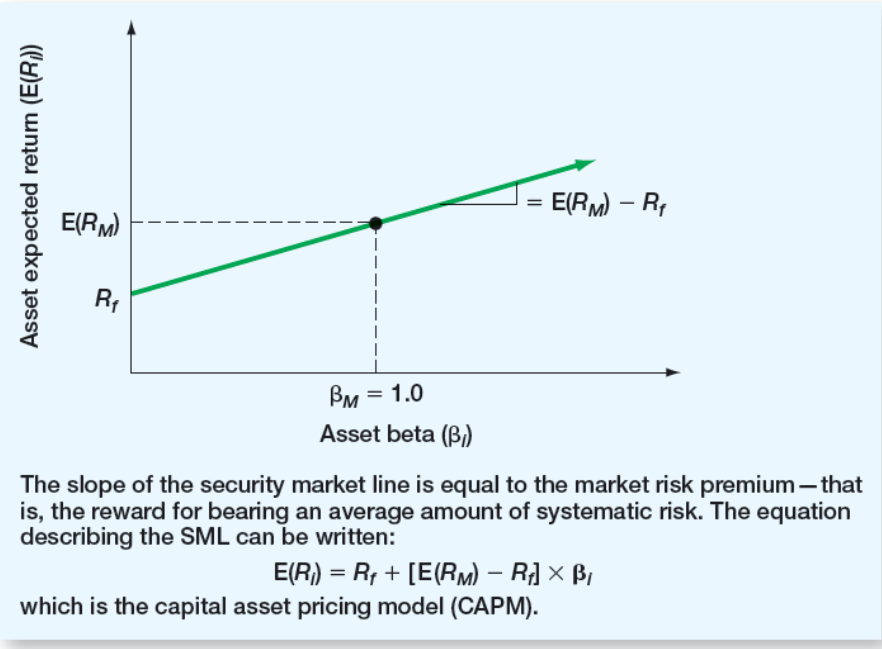

Security Market Line

- The security market line (SML) is the representation of market equilibrium

- The slope of the SML is the reward-to-risk ratio: $\frac{E(R_M)-R_f}{\beta_M}$

- But since the beta for the market is always equal to one, the slope can be rewritten

- Slope $=E(R_M) – R_f =$ market risk premium

Put it all together...

The Capital Asset Pricing Model (CAPM)

$E(R_i)=R_f+\beta_i(E(R_M)-R_f)$

- If we know an asset's systematic risk, we can use the CAPM to determine its expected return

- This is true whether we are talking about financial assets or physical assets

Factors Affecting Expected Return

- Pure time value of money: measured by the risk-free rate

- Reward for bearing systematic risk: measured by the market risk premium

- Amount of systematic risk: measured by beta

CAPM: Example

Consider the betas for each of the assets given earlier. If the risk-free rate is 4.15% and the market risk premium is 8.5%, what is the expected return for each?| Asset | Beta | $E(R_i)$ |

|---|---|---|

| DIS | 1.444 | 4.15 + 1.444(8.5) = 16.42% |

| KO | 0.797 | 4.15 + 0.797(8.5) = 10.92% |

| AAPL | 1.472 | 4.15 + 1.472(8.5) = 16.66% |

| PG | 0.647 | 4.15 + 0.647(8.5) = 9.65% |

Extra Practice

Example 1

One year ago, Avril purchased 3,600 shares of Lavigne stock for $\$$101,124. Today, she sold those shares for $\$$26.60 a share. What is the total return on this investment if the dividend yield is 1.7 percent?Example 2

A stock has yielded returns of 6 percent, 11 percent, 14 percent, and -2 percent over the past 4 years, respectively. What is the standard deviation of these returns?Example 3

You purchased 1,300 shares of LKL stock 5 years ago and have earned annual returns of 7.1 percent, 11.2 percent, 3.6 percent, -4.7 percent and 11.8 percent. What is your arithmetic average return?What is the geometric return?Example 4

What is the expected return, variance, and standard deviation?| State | Probability | Go Nuts for Donuts Inc. |

|---|---|---|

| Boom | .25 | .15 |

| Normal | .5 | .08 |

| Slowdown | .15 | .04 |

| Recession | .10 | -.03 |

Example 5

Consider the following information on returns and probabilities:| State | Probability | Apple | Disney |

|---|---|---|---|

| Boom | .25 | 15% | 10% |

| Normal | .6 | 10% | 9% |

| Recession | .15 | 5% | 10% |

What are the expected return and standard deviation for a portfolio with an investment of $\$$6,000 in Apple and $\$$4,000 in Disney?

Example 6

The risk free rate is 4%, and the required return on the market is 12%.- What is the required return on an asset with a beta of 1.5?

- What is the reward/risk ratio?

- What is the required return on a portfolio consisting of 40% of the asset above and the rest in an asset with an average amount of systematic risk?

Why Cost of Capital is Important?

- We know that the return earned on assets depends on the risk of those assets

- The return to an investor is the same as the cost to the company

- Our cost of capital provides us with an indication of how the market views the risk of our assets

- Knowing our cost of capital can also help us determine our required return for capital budgeting projects

Required Return

- The required return is the same as the appropriate discount rate and is based on the risk of the cash flows

- We need to know the required return for an investment before we can compute the NPV and make a decision about whether or not to take the investment

- We need to earn at least the required return to compensate our investors for the financing they have provided

Financial Policy and Cost of Capital

Big picture

- A firm's cost of capital reflects the required return on the firm's assets as a whole

- A firm uses both debt and equity capital

- Cost of capital will be a mixture

Cost of Equity

- The cost of equity is the return required by equity investors given the risk of the cash flows from the firm

- There are two major methods for determining the cost of equity

- Dividend Growth Model

- SML, or CAPM

DGM Approach: Reminder

$R_E=\frac{D_1}{P_0}+g$

DGM: Pros and Cons

- Advantages

- easy to understand and use

- Disadvantages

- Requires a dividend payment

- Requires growth rate to be constant

- Extremely sensitive to growth rate estimate

- Does not explicitly consider risk

SML Approach: Reminder

$R_E=R_f+\beta_E(E(R_M)-R_f)$

SML or CAPM: Pros and Cons

- Advantages

- Explicitly adjusts for systematic risk

- Applicable to all companies, as long as we can estimate beta

- Disadvantages

- Have to estimate the expected market risk premium, which does vary over time

- Have to estimate beta, which also varies over time

- We are using the past to predict the future, which is not always reliable

Cost of Debt

- The cost of debt is the required return on our company's debt

- We usually focus on the cost of long-term debt or bonds

- The required return is best estimated by computing the yield-to-maturity on the existing debt

- The cost of debt is NOT the coupon rate

Weighted Average Cost of Capital (WACC)

- We can use the individual costs of capital that we have computed to get our "average" cost of capital for the firm

- This "average" is the required return on the firm's assets, based on the market's perception of the risk of those assets

- The weights are determined by how much of each type of financing is used

Capital Structure Weights

- Notation

- E = market value of equity = # of outstanding shares times price per share

- D = market value of debt = # of outstanding bonds times bond price

- V = market value of the firm = D + E

- Weights

- $w_E = \frac{E}{V} =$ percent financed with equity

- $w_D=\frac{D}{V}=$ percent financed with debt

Taxes

- We are concerned with after-tax cash flows, so we also need to consider the effect of taxes on the various costs of capital

- Interest expense reduces our tax liability

- This reduction in taxes reduces our cost of debt

- Dividends are not tax deductible, so there is no tax impact on the cost of equity

WACC

$WACC=w_ER_E+w_DR_D(1-T_C)$

Large Example

Go Nuts for Donuts! Inc.

Go Nuts for Donuts! Inc. has 50,000,000 shares outstanding that currently trade at $\$$80 a share. The firm recently paid a dividend of $\$$3.5 and its past 5-year growth rate in dividends is 6%. It's systematic risk, measured by beta, is 1.15. The firm has $\$$1 billion in outstanding debt, face value. The current quote on the bond is 110 and the coupon rate is 9% (semi-annual coupon payments). The bonds have 15 years to maturity. Assume a tax rate of 40%. The market risk premium is 9% and the risk free rate is 5%.Solution: Cost of Equity

What is the Cost of Equity?

- Dividend Growth Model $R_E=\frac{D_1}{P_0}+g=\frac{3.5(1.06)}{80}+.06=.106375=10.64%$

- CAPM $R_E=R_f+\beta_E(E(R_M)-R_f)=5+1.15(9)=15.35%$

Solution: Cost of Debt

What is the Cost of Debt?

- N=15*2=30

- I%=3.927*2=$7.854=R_D$

- PV=-1100

- PMT=90/2=45

- FV=1000

What is the After-Tax Cost of Debt?

$R_D(1-T_C)=7.854(1-.4)=4.712%$

Solution: Weights

What are the capital structure weights?

- E=50,000,000*80= 4 billion

- D=1,000,000,000*1.1=1.1 billion

- V=4 + 1.1 = 5.1 billion

- $w_E=\frac{E}{V}=\frac{4}{5.1}=.7843$

- $w_D=\frac{D}{V}=\frac{1.1}{5.1}=.2157$

Solution

What is the WACC?

- Using DGM: $WACC=w_ER_E+w_DR_D(1-T_C)$

- Using CAPM: $WACC=w_ER_E+w_DR_D(1-T_C)$

$WACC=.7843(10.64)+.2157*(7.854(1-.4)=9.36$

$WACC=.7843(15.35)+.2157*(7.854(1-.4)=13.06$

Issues with WACC

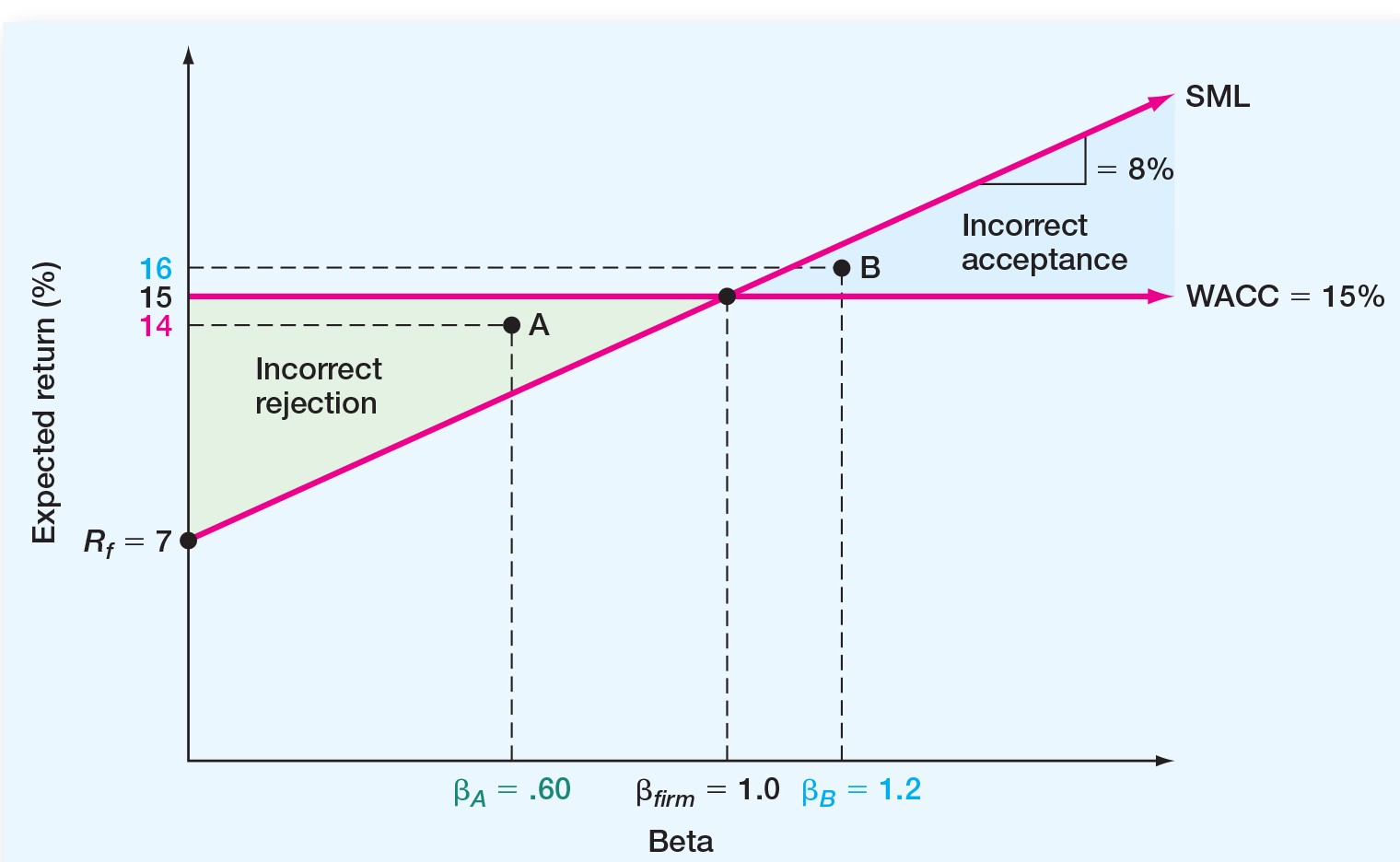

SML and WACC

Divisions and WACC

- Using firm-level WACC can lead to:

- Incorrectly accepting high risk projects if $\beta$ of project is higher

- Incorrectly rejecting low risk projects if $\beta$ of project is lower

- Solutions:

- Pure Play: Use similar investment(company) in marketplace

- Subjective: Make risk adjustments to WACC.

Extra Practice

Example 1

- Suppose your company has an equity beta of .58, and the current risk-free rate is 6.1%. If the expected market risk premium is 8.6%, what is your cost of equity capital?

- Suppose that your company is expected to pay a dividend of $\$$1.50 per share next year. There has been a steady growth in dividends of 5.1% per year and the market expects that to continue. The current price is $\$$25. What is the cost of equity?

- Suppose we have a bond issue currently outstanding that has 25 years left to maturity. The coupon rate is 9%, and coupons are paid semiannually. The bond is currently selling for $\$$908.72 per $\$$1,000 bond. What is the cost of debt?

Example 2

Suppose you have a market value of equity equal to $\$$500 million and a market value of debt equal to $475 million. What are the capital structure weights?Example 3

A corporation has 10,000 bonds outstanding with a 6% annual coupon rate, 8 years to maturity, a $\$$1,000 face value, and a $\$$1,100 market price. The company's 500,000 shares of common stock sell for $\$$25 per share and have a beta of 1.5. The risk free rate is 4%, and the market return is 12%. Assuming a 40% tax rate, what is the company’s WACC?Key Learning Outcomes

- First Lesson: Average Returns

- Historical returns

- Risk Premium

- Second Lesson: Return Variability

- Standard deviation

- Arithmetic vs Geometric return

- Capital market efficiency

- Efficient market hypothesis

Key Learning Outcomes

- Calculate:

- Expected return, variance, and standard deviation

- Do so for a portfolio of assets

- Understand diversification

- Total risk, Systematic risk, Unsystematic risk

- Beta, Security Market Line and CAPM

- Understand concept and derivation

- Calculate Portfolio Beta

- Use CAPM

Notes on Notations

$R$= Return$R_i$= Return for stock i (index (i) can be i, j, or any letter)

$\sigma^2_i$ Variance for stock i

$\sigma_i$ Standard deviation for stock i

$E(R_i)$= Expected return for stock i

$E(R_p)$= Expected return for a portfolio

$p_i$= Probability of state i occurring

$E(R_{p,i})$= Expected return of the portfolio in state i

$R_f$= risk free rate or expected return on the risk free asset

$\beta_i$= Beta of stock i $\beta_m$= Beta of the market (equal to one)