Discounted Cash Flow Valuation Part 2

Created by David Moore, PhD

Reference Material: Wall Street Prep DCF Modeling Chapter 4Key Concepts

- Diluted Shares Outstanding

- Dealing with Equity Issued to Employees

- Loose Ends and Minor Tweaks

- Mid-year Discounting

- Cash

- Cross Holdings

- Estimate MV Debt

- Dual Class Shares

- Levered Free Cash Flows

- Sensitivity Analysis

- Final Thoughts on Valuation

Shares Outstanding

What is the right shares outstanding to divide equity value by?- Shares outstanding?

- Diluted Shares outstanding?

- Issue is how to deal with equity granted to employees.

Forms of Equity Grants

- Restricted Stock Units (RSUs)

- Employee Options

Restricted Stock Grants

How to incorporate into valuation?- Past: Include in shares outstanding (even if not vested, Why?)

- Future: Estimate value as % of revenue. Forecast and include in compensation expense.

Options

Approaches to incorporating into valuation:

- Treasury Approach

- Treasury with a Twist Approach

- Option Value Approach

Option Terminology

(Note all compensation options are call options)- Exercise or strike price: Price at which you can buy the stock.

- In-the-money: If the strike price is less than the current stock price.

- Exercise: Invoking the terms of the option contract, i.e., buying the stock.

- Unexercisable: Options that have been granted to the employee but not yet vested. The employee cannot exercise the option until it vests, i.e., becomes exercisable.

WRONG! Diluted Share Count Approach

- Adjust the denominator (shares outstanding) for shares if options are exercised

- Look at in the money options and adjust shares by number of in the money options

- Issue?

- Fails to consider that exercising options will bring cash in.

Treasury Approach

- Follow the diluted shares approach for shares

- Add the value received from the exercise of options to the equity value

- Ignores the time premium on the options

Treasury with a Twist Approach (Our method)

- Use the proceeds to buy back the stock at the current price

- Adjust the shares for the options exercised AND the shares repurchased

- Equity value remains unchanged. Why?

- Still ignores time premium

Option Value Approach

- Use existing option value model (ex. Black Scholes) to value employee options

- Subtract from Equity Value

- Divide by existing shares (don't mess with share count)

- Issues:

- Option models not designed for employee options.

- Employee options are long-term, not liquid, exercised early, dilutive, and have vesting schedules.

- Note: can multiply by (1-tax rate) as options give tax break

Options Outstanding vs Exercisable

- Options outstanding includes unexercisable options, i.e., options that have not ye vested.

- Why might it be appropriate to include unexercisable options? (Think about modeling assumptions you've likely made)

- Similar logic applies to performance based equity grants.

Basic Example

You have calculated the equity value of GoNuts4Donuts at $150 million. The latest share count is 15 million. Your boss says "Ok, well this firm is valued at $10/share!" (10 million if you work at MSCNBC/NYT!). You know this is wrong since the firm has the following equity grants: 2 million options outstanding with an exercise price of $6 and 1 million unvested RSUs. You have also calculated the value of the options using Black Scholes at $7.80 a share. The stock is currently trading at $12/share. What is the new value per share under the Treasury Method? Treasury with a Twist Method? Option Value Method?Solution

Treasury

$Value/Share=\frac{150M+(2M*6)}{15M+2M+1M}$$Value/Share=9$

Treasury with Twist

$Value/Share=\frac{150M}{15M+2M+1M-\frac{2M*6}{12}}$$Value/Share=8.82$

Option Value

$Value/Share=\frac{150M-(2M*7.80)}{15M+1M}$$Value/Share=8.40$

Loose Ends

Mid-year Discounting

When do cash flows occur?When do we assume they occur?

- Solution is to discount as if they occur on average in the middle of the year

- $\frac{FCFF_1}{1+WACC^{0.5}}+\frac{FCFF_2}{1+WACC^{1.5}}+...$

- In Excel. Multiply the NPV by $(1+WACC)^{0.5}$

Cash

- Best practice: Keep it out of valuation!

- Ex. Do not include interest income from Cash

- Add cash back at the end

Premium/Discount Cash

- Cash itself is not the issue!

- When is cash bad (discount)?

- Probability that company will waste cash

- Think of activist investors?

- When is cash good (premium)?

- In markets where access to capital is of concern.

- More likely in foreign countries

- Think of start-up ex. Lyft vs Uber

Cross Holdings

- Minority passive: I/S shows dividends, B/S shows original investment

- Minority active: I/S income from cross holding, B/S original investment plus retained earnings

- Majority active: financial statements are consolidated. (act like you own 100% until...Minority interest (non controlling interest) under Equity)

How to deal with Cross Holdings

- Figure out the accounting method!

- Add in value of minority passive or minority active

- Subtract value of non-controlling interest

Company A holds a passive 10% of Company B who has a MV of 500 million. They also a hold 60% of company C that has been fully consolidated with a book value of $ 40 million. What is the value?

What is the issue?

Value needs to be intrinsic!!!

Perfect World

Assume the value of company A is $750 million using only the parent financials. You separately value company B and C at $250 million each using their intrinsic value. What is the value of company A?

Ideal Solution

- Value the company without cross holdings (using unconsolidated financial statements)

- Value the equity (intrinsically) of each cross holding individually

- Add each of the values of cross holdings (value times % held) to value of the company.

More Realistic Alternative

- For majority holdings (under full consolidation): Multiply the BV of minority interest by the Price-to-Book ratio for the industry of the subsidiary and subtract from enterprise value of parent

- For Minority holdings: Multiply the BV of holdings by the Price-to-Book ratio for the industry of the subsidiary and add to the enterprise value of the parent

Even More Realistic Alternative

- For majority holdings (under full consolidation): Subtract the book noncontrolling (minority) interest from enterprise value of parent

- For Minority holdings: Add the book asset value of holdings (marketable securities or Investments) to the enterprise value of parent

MV of Debt

- Wait what?

- Can estimate (treat as gigantic bond):

- Treat debt amount as face value

- Interest expense is coupon

- Discount at cost of debt

- Use average maturity

This will be similar to BV for healthy companies.

What about distressed companies?

Estimate MV of Debt

A company has a BV of debt of $1 billion and shows an interest expense of $132 million. The average maturity on the debt is 4 years and you estimate the cost of debt to be 8.2%. What is your best estimate for the MV of debt?

N=4; YTM=8.2%; PMT=132M; FV=1,000M

Answer: $1,164.87 million

Dual Class Stock

How do we value dual class shares?

Apply a premium to the voting class shares (5-10%). Adjust for difference in cash flow rights directly.

Dual Class Example

On 1-800-Flowers.Com Inc's most recent filing it states "The number of shares outstanding of each of the Registrant's classes of common stock as of January 31, 2020: Class A Common Stock of 35,753,963 and Class B Common Stock of 28,542,823 share" Voting rights are 10-1 (B-A) and Class B is not publicly traded. If you value the equity at $1.2 billion and place a 5% premium on voting shares, what is the value per share? (assume no dilutive securities outstanding)Dual Class Answer

$Value/NonVoting Share=\frac{1200}{35.754+28.543*(1.05)}$$Value/NonVoting Share=18.26$

Levered Free Cash Flows or FCFE

$FCFE=NonCashNI+DA-Investments$

$-(Debt Repaid - Debt Issued)$

Discount using Cost of Equity

Example

You have been asked to value a firm with expected annual after-tax cash flows, before debt payments, of $100 million a year in perpetuity. The firm has a cost of equity of 12.5%, a market value of equity of $600 million and a market value of debt of $400 million. If the debt is perpetual and the after-tax interest rate on debt is 6.25%.What if the MV if of equity was $800 million?

Answer1

$WACC=\frac{400}{1000}6.25+\frac{600}{1000}12.5=10$Using unlevered cash flows:

$Value of Firm=\frac{100}{.1}=1000$ $Value of Equity=1000-400=600$

Using levered cash flows:

$FCFE=100-(400*.0625)=75$ $Value of Equity=\frac{75}{.125}=600$

Answer2

$WACC=\frac{400}{1200}6.25+\frac{800}{1200}12.5=10.42$Using unlevered cash flows:

$Value of Firm=\frac{100}{.1042}=960$ $Value of Equity=960-400=560$

Using levered cash flows:

$FCFE=100-(400*.0625)=75$ $Value of Equity=\frac{75}{.125}=600$

Will you get same answer?

- Issue arises because we use MV of Equity in WACC

- Problem gets compounded with growth (need to keep debt ratio fixed)

- Need to iterate through to get cost of capital (also constant debt rate)

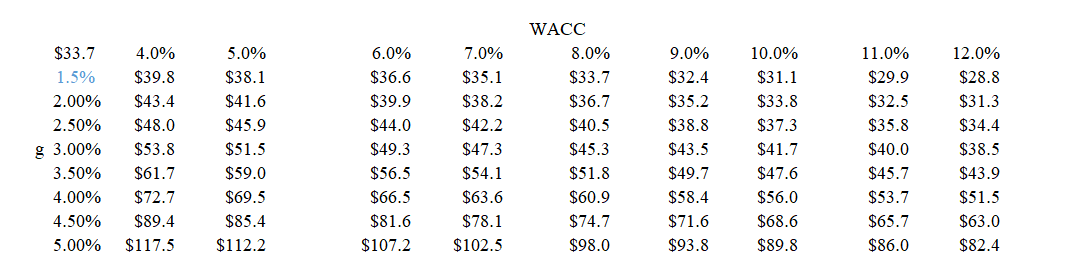

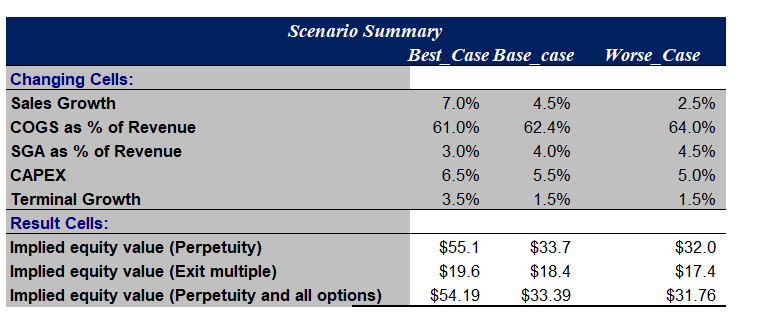

Sensitivity Analysis

- What are key drivers?

- Best and worst case scenarios?

- Reasonable range?

Excel Tools

- Data Tables

- Vertical

- Horizontal

- Two-way

- Scenario Manager

- Allows multiple inputs to be varied at once

Example: Data Table

Example: Scenario Manager

Final Thoughts

Some Valuation Notes

- Good valuation is at the intersection of the numbers and the story

- Bad valuations come when you are at one end or the other.

- Key story (number) drivers

- Company history

- The markets and its growth

- Competitors it faces (and will face)

- Macro environment

Valuation Steps

- Survey the landscape

- Create a narrative for the future

- Simple, focused, and grounded

- Common sense check the narrative

- Is it possible? plausible? probable?

Is it?

- Impossible

- Growth rate greater than economy

- Bigger than total market

- Profit margin>100%

- Depreciation without capex

- Implausible

- Growth without reinvestment

- Profits without competition

- Returns without risk

- Improbable

- High Growth and low risk

- High Growth and low reinvestment

- Low risk and high reinvestment

More steps

- Connect narrative to key drivers of value

- Be ready to modify narrative as information (events) updates