Relative Valuation: Multiples

Created by David Moore, PhD

Reference Material: Wall Street Prep Trading Comps and Transaction CompsKey Concepts

- Relative Valuation Intuition

- Trading Comps Steps

- Selecting Comps

- Common Multiples

- Last-Twelve Months vs Forward

- Application

- Transaction Comps

- Excess Cash

Relative Valuation

- Most asset valuations are relative

- Most equity valuations on Wall Street are relative valuations (approx. 85% of equity research)

- DCF valuations are often influenced by multiples

- Terminal value is often calculated using multiples

Relative valuation is pricing not valuation.

Why Relative?

- More likely to reflect market perceptions and moods

- Will always lead to significant number of securities that are undervalued or overvalued

- Tailors to portfolio managers (evaluation is relative)

- Require much less information

What is a multiple?

$Multiple=\frac{\text{What you are paying for an asset}}{\text{What you are getting in return}}$

- Numerator: MV of Equity or Enterprise Value

- Denominator

- Revenues or Drivers

- Earnings

- Cash flow

- Book Value

Three Multiple Checks

- Define the multiple

- Describe the multiple

- Apply the multiple

Define the Multiple

- Value and standardizing variable must be to same claimholder

- Multiple must be uniformly estimated for comparable assets

Example:Price to earnings

- Price: Current or average?

- EPS: Most recent, trailing 12 month, forecast

Describe the Multiple

- Average and standard deviation

- Median: can be more reliable depending on sample size and outliers

- How to deal with outliers?

- Throw out? Does this bias estimate?

- Multiples have skewed distributions

Apply the multiple

- What is a comparable firm?

- Same risk, growth, and cash flow characteristics

- Sampling trade-off:

- Small sample that are "just like you"

- Large sample that are "mostly kinda like you"

- Conclude stock is under or over valued relative to comparable group.

Market Assumption

Relative Valuation Steps

- Select comparable companies

- Pick which multiples you will use

- Pick timeframe (LTM vs forward)

- Select distributional statistics

- Apply statistic to corresponding metric to arrive at a value

Selecting comparables

- Ideally want to match on value drivers

- Almost always will be comparing apples to oranges

- Sources:

- Equity research

- 10-K

- SIC code screens

- Mergent (other financial website)

- Given list of possible comps, narrow based on nature of business and growth prospects (value drivers)

Common Multiples

- Equity Multiples

- P/E ratio

- PEG ratio

- Price to book Ratio

- Enterprise Multiples

- EV/EBIT

- EV/EBITDA

- EV/Revenue

P/E Ratio

$P/E=\frac{Share Price}{EPS}=\frac{Equity Value}{Net Income}$- Issues:

- Requires similar capital structure

- Relies on accounting profits

- Value drivers:

- PE=f(Payout Ratio, g, cost of equity)

PEG Ratio

$PEG=\frac{PE ratio}{g}$- Issues:

- Does not actually solve for g issue

- Relationship is non-linear

- Value drivers:

- PEG=f(Payout Ratio, g, cost of equity)

Price to book Ratio

$P/BV=\frac{Equity Value}{Book Value of Equity}$- Issues:

- BV can be negative

- Still a historical cost

- Value drivers:

- Price to Book=f(ROE, g, cost of equity, payout ratio)

EV/EBIT

$=\frac{Enterprise Value}{EBIT}$- Removes leverage

- Value drivers:

- EV/EBIT=f(rate of reinvestment, g, WACC, t)

EV/EBITDA

$=\frac{Enterprise Value}{EBITDA}$- Removes leverage

- Useful if D&A is large

- Value drivers:

- EV/EBITDA=f(rate of reinvestment, g, WACC, t, DA)

EV/Sales

$=\frac{Enterprise Value}{Sales}$- Assumes comparable cost structure

- Useful for negative earnings companies

- Value drivers:

- EV/Sales=f(after-tax operating margin,rate of reinvestment, g, WACC)

Other multiples

- EV/monthly subscribers

- EV/website hits

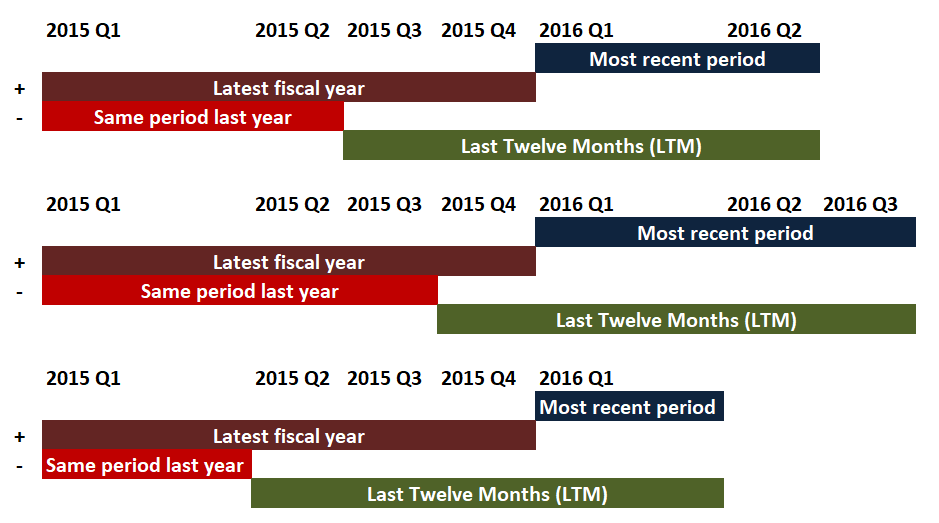

Period of Measurement

- Need to measure denominator

- Two common periods:

- Last (trailing) twelve months

- Forward looking (estimate next year)

Last Twelve Months (LTM)

Practice

LTM Practice

Find the LTM Sales, EBIT, and Net Debt for Microsoft (MSFT), Best Buy (BBY) , and Walt-Disney (DIS)

Select Statistic

- Most common is to use average

- Why might average be misleading?

- Median reduces impact of outliers

- Important to view/analyze the distribution

Example 1: Apply the Multiple

Go Nuts trades at $30 a share and has 30 million shares outstanding. They had revenue of $1 billion, EBITDA of $200 million, Net income of $75 million and Net Debt of $200 million What is Go Nuts implied share price under each multiple? Are they overvalued/undervalued? What are the ratios for Go Nuts?

| Peer Firm | EV/Sales | EV/EBITDA | P/E |

|---|---|---|---|

| Blue Star | 1.0x | 6.0x | 15.0x |

| Voodoo | 2.0x | 8.0x | 19.0x |

| Randy's | 1.5x | 6.5x | 17.0x |

| Donut Man | 1.0x | 5.8x | 14.6x |

| Average | 1.4x | 6.6x | 16.4x |

Example 1: Solution

| EV/Sales | EV/EBITDA | P/E | |

|---|---|---|---|

| Average (from Peers) | 1.4x | 6.6x | 16.4x |

| Enterprise Value | 1.4x1000=1400 | 6.6x200=1320 | N/A |

| Equity Value | 1400-200=1200 | 1320-200=1120 | 16.4*75=1230 |

| Share Price | 1200/30=40 | 1120/30=37.3 | 1230/30=41 |

| Overvalued | No (30<40) | No (30<37.3) | No (30<41) |

| Go Nuts Ratio | 1100/1000=1.1x | 1100/200=5.5x | 900/75=12x |

Transaction Comps

- Transaction Value/ Target EBITDA

- TV/ Target Revenue

- TV/ Target EBIT

- Offer Price per share/ Target EPS

- Offer value/Target NI

TV is EV and Offer Value is Equity Value in M&A context

Transaction Comps Example

Your company has revenue of $20B, EBITDA of $6.5B, Net income of $5B, and net debt of $1B. There are currently 1B shares outstanding and the current stock price is $50. Given the information below what is the implied share price under each transaction comparable?

| Transaction | TV/Revenue | TV/EBITDA | Offer Price/EPS |

|---|---|---|---|

| A | 2.00 | 8.00 | 16.00 |

| B | 3.00 | 12.00 | 20.00 |

| C | 1.50 | 11.00 | 16.00 |

| D | 2.50 | 13.00 | 18.00 |

| Mean | 2.25 | 11.00 | 17.50 |

Solution

| TV/Revenue | TV/EBITDA | Offer Price/EPS | |

|---|---|---|---|

| Mean | 2.25 | 11.00 | 17.50 |

| TV | 2.25*20=45 | 11*6.5=71.5 | N/A |

| Offer Value | 45-1=44 | 71.5-1=70.50 | 17.5*5=87.5 |

| Offer Price | 44/1=44 | 70.5/1=70.50 | 87.5/1=87.5 |

| Overvalued? | Yes (50>44) | No (50<70.5) | No (50<87.5) |

Excess Cash

- Use peer average Cash as a % of Total Assets as proxy for expected cash

- Excess cash is then the Max of Cash-Expected Cash and zero

Excess Cash Example

Your firm has cash holdings of $29.5M and Total assets of $800M. You calculate that the average Cash as a % of TA for your peer firms is 8.9%. What is the level of excess cash for your firm?=MAX(29.5-(800*.089),0)=0

What if Total Assets were $300M?

=MAX(29.5-(300*.089),0)=2.8