Discounted Cash Flow Valuation Part 1

Created by David Moore, PhD

Reference Material: Wall Street Prep DCF Modeling Chapter 3 and 5Key Concepts

- Terminal Value

- Perpetuity Growth Rate

- Exit Multiple

- Cost of Capital

- Estimating Weights

- Beta and the Cost of Equity

- Cost of debt

- Enterprise Value

DCF Overview

- Free Cash flows (forecast period)

- Terminal Value

- Discount rate

Infinite Horizon Problem

- Assume a fixed length forecast window

- Followed by terminal window of infinite length

Terminal Value

Terminal 1: Perpetuity Growth Rate

- Growing Perpetuity

- Need a discount rate (r)

- Need a growth rate (g)

Growing Perpetuity

$PV=\frac{C}{r-g}$

Important: Growth rate (g) must be less that interest rate r. If g>r the formula will not work!

Example_1

Given an interest rate of 7 percent per year, what is the value at date t = 8 of a perpetual stream of 500 annual payments that begins at date t = 17 and grows at 5% thereafter? What if the growth rate was 10%?Example_1 Solution

Given an interest rate of 7 percent per year, what is the value at date t = 8 of a perpetual stream of 500 annual payments that begins at date t = 17 and grows at 5% thereafter?$PV_{t=16}=\frac{500}{.07-.05}=25000$

$PV_{t=8}=\frac{25000}{(1+.07)^{16-8}}=14550.23$

What if the growth rate was 10%?

r<g ; cannot solve

Getting the Rates

- r: Use the WACC (more on this later)

- g: A reasonable assumption must be less than the growth rate of overall economy

- Good Assumption: Nominal risk free rate = real Rf rate + expected inflation

- Typical range for g is 2-5%

- 2009-2015 Risk free:2.57% GDP: 3.14%

Terminal 2: Exit Multiple

- Apply valuation multiple to operating metric

- Typical to use comparables Damodaran Website

$Terminal Value= Multiple*Operating Metric$

Example (typical): EBITDA ratio x EBITDA in terminal year.

PV of Terminal Value

- Can be a different discount rate than rate used for terminal window

Issues with Terminal Value Methods

- Perpetuity Growth: Technically sound but requires assumption of when stable growth begins AND stable growth rate.

- Multiples: Makes the valuation a relative (rather than intrinsic) valuation.

Revisit Example 1

Revisit Example 2

Cost of Capital

First Principle of Valuation

Who do unlevered cash flows belong to?Appropriate Discount Rate?

- Free cash flows to the firm discount at cost of capital to the FIRM

- WACC is used as estimate of cost of capital if valuing the entire firm

- Discussed later: Levered cash flows (to equity) use Cost of Equity

What is a Discount rate?

- Incorporate all risk that affect the asset (business)

- Reflect the risk perceived by the marginal investor

- Opportunity cost of taking on risk of investing in the company

- Required return

- Return to investor is the same as cost to the company

Cost of Capital (WACC)

- The firm's assets are financed through debt and equity (RHS of Balance sheet)

- We can use the individual costs of capital for debt and equity to get our "average" cost of capital for the firm

- This "average" is the required return on the firm's assets, based on the market's perception of the risk of those assets

- The weights are determined by how much of each type of financing is used

Cost of Equity

- Who is the equity investor?

- What risks do they face?

- What is their opportunity cost?

Cost of Debt

- Cost of debt is not the coupon rate

- Interested in yield if the firm issued more debt.

- Rate at which you could borrow currently

- Only concerns long-term debt. (Why?)

- Is all debt observable?

Capital Structure Weights

Should we use book or market values?- Notation

- E = market value of equity

- D = market value of debt

- V = market value of the firm = D + E

- Weights

- $w_E = \frac{E}{V} =$ percent financed with equity

- $w_D=\frac{D}{V}=$ percent financed with debt

Taxes

- We are concerned with after-tax cash flows, so we also need to consider the effect of taxes on the various costs of capital

- Interest expense reduces our tax liability

- This reduction in taxes reduces our cost of debt

- Dividends are not tax deductible, so there is no tax impact on the cost of equity

- We use the marginal tax rate

WACC

$WACC=w_ER_E+w_DR_D(1-T_C)$

$w_E$=Weight of Equity

$R_E$=Cost of Equity

$w_D$=Weight of Debt

$R_D$=Cost of Debt

$T_C$=Marginal Corporate Tax rate

Simple Example

The estimated market value of a firm's debt (book value) is 4 million and the market cap is 6 million. The cost of equity is 10% and the cost of debt is 6%. The marginal tax rate is 21%. What is the cost of capital for this firm i.e., What is the WACC?

Answer:7.896%

Estimating Weights

- Equity: Market value of Equity

- Shares outstanding X Share price

- Debt: Market value of debt

- Unobservable...

Estimating Market Value of Debt

- Standard to use Book value of debt

- Only concerned with Long-term Debt!

- Don't forget current portion of LTD

- Also include Notes payable or Lease obligations (any interest bearing long term debt)

- Some Modelers include cash as negative debt (we will not)

Example

What are the market weights for a firm with a share price of $18.5 and 30.5 million shares outstanding. The firm has long-term debt of $385 million and shows $35 million under current portion of long-term debt?Answer: Weight of Equity = 57.33% and Weight of Debt = 42.67%

Estimating Cost of Debt

- Two Methods

- Yield

- Default Spreads

Yield

- Use yield on long-term (10-30 year) straight bonds

- Find yields here

- Major issue is most companies do not offer long term straight bonds that are liquid and widely traded

Default Spreads

- Use the firm rating to estimate the default spread.

- Find default spreads here

- Add default spread to risk free rate

- 10-year rate is most liquid and allows for calculation of default spreads

- Use synthetic rating if firm has bonds with different ratings

- No bond rating? Use interest coverage ratio

Cost of Equity

What makes up a risk adjusted cost of equity?- Risk free rate

- Relative risk of company

- Equity Risk Premium

Market Risk Models

- Capital Asset Pricing Model (CAPM)

- Multi-factor Models (won't be using)

The Capital Asset Pricing Model (CAPM)

$E(R_i)=R_f+\beta_i(E(R_M)-R_f)$

- If we know an asset's systematic risk, we can use the CAPM to determine its expected return

- This is true whether we are talking about financial assets or physical assets

Market Equilibrium

$\frac{E(R_A)-R_f}{\beta_A}=\frac{E(R_M)-R_f}{\beta_M}$

Security Market Line

- The security market line (SML) is the representation of market equilibrium

- The slope of the SML is the reward-to-risk ratio: $\frac{E(R_M)-R_f}{\beta_M}$

- But since the beta for the market is always equal to one, the slope can be rewritten

- Slope $=E(R_M) – R_f =$ market risk premium

Factors Affecting Expected Return

- Pure time value of money: measured by the risk-free rate

- Reward for bearing systematic risk: measured by the market risk premium

- Amount of systematic risk: measured by beta

Simple Example

What is the expected return for a company with a beta of 1.5 if the risk free rate is 3% and the market risk premium is 7%?Answer: 13.5

Risk Free Rate ($R_f$)

Investment must have:

- No default risk

- No reinvestment risk

- Time horizon and zero-coupon

- We will proxy with 10-year Treasury Bond

- Note: Currency matters (if non-USD)

Should you Normalize risk free rate?

NO!- Risk free is alternative investment to stock

Beta

$\beta_{Equity}=\frac{Cov(R_i,R_M)}{Var(R_M)}=\frac{\sigma_{i,M}}{\sigma_M^2}$

, which is equal to the slope from regressing firm returns on market returns

Issues with (Regression) Beta

- High standard error (Remember Statistics!)

- It is backward looking

- It reflects the firm's business mix over the period of the regression, not the current mix

- It reflects the firm's average financial leverage over the period rather than the current leverage.

- Requires data

Determinants of Beta

- Business risk

- Asset/Industry Beta

- Nature of product/service offered and operational leverage

- Financial risk

- Leverage

Beta and Leverage

$\beta_{Equity}=(1+(\frac{D}{E}*(1-T_C))\beta_{Asset}$Note: Assumes riskless debt i.e., debt has a beta of zero.

Ideal Beta (for valuation)

- Start with beta of the business that firm is in

- Adjust business beta for operating leverage

- Use the financial leverage of the firm to estimate the equity beta for the firm

Bottom Up Beta

- Unlever comparable industry peer betas (i.e., compute asset betas)

- Average them, to get an estimate of the industry (asset) beta

- Lever the average industry beta to the firm's (optimal) capital structure

Why Bottom Up?

- Lower Standard error

- Adjusted to reflect changes in business and financial risk

- Does not require historical stock prices

Conglomerates

- Can calculate an asset beta for each business sector

- Weight each asset beta by market value

- Issue is market value unknown

- Ideally you would estimate

- Alternatives are to use revenue or operating income

Market (Equity) Risk Premium

- Analysts(lack of) consensus: 1-10%

- 6.5% – 8.5% most common

- 1926 – 2005 period, large U.S. stocks averaged 8.5% higher returns than T-bills

- Damodaran to the rescue

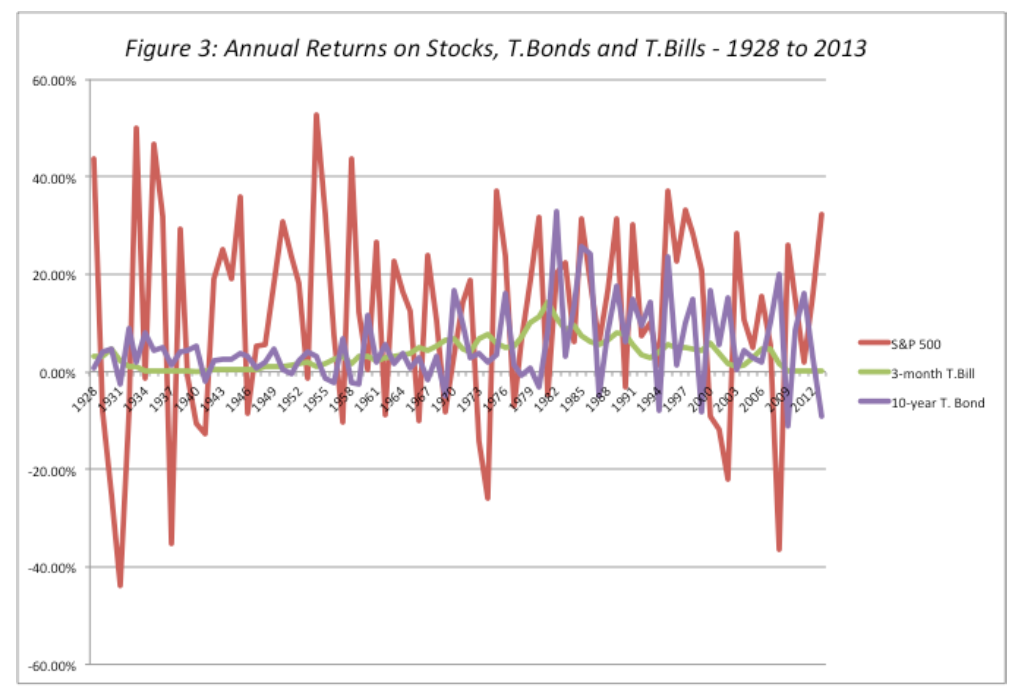

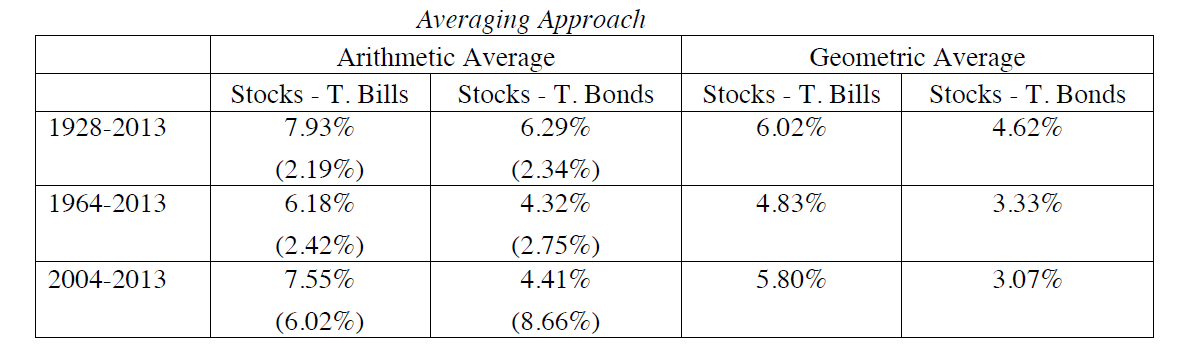

Historical ERP

Averaging

Let's practice!

- Calculate Stryker(SYK) Beta (using historical prices)

- Using CAPM What is Stryker's Cost of equity?

- Using Cardinal Health (CAH), Medtronic (MDT), Abbott Laboratories (ABT) and Boston Scientific (BSX) calculate the bottom up beta. Assume a tax rate of 21%.

Forecast vs Terminal Window

- Can use different rates

- Standard for terminal rate to be lower

- Lower because slowed growth and (presumably) lower risk

- Possible assumption: Industry average beta (lower)

Enterprise Value

- We've valued FCFF at the cost of capital to the firm

- Enterprise value is FIRM value

- Equity Value=Enterprise Value - Net Debt

- Net Debt= Debt-Cash

- Also need to remove preferred stock and non-controlling interest

Revisit Gentex

Revisit Alaska Airlines