Making Capital Investment Decisions

Created by David Moore, PhD

Reference Material: Chapter 10 of TextbookKey Concepts

- Project Cash Flows

- Incremental Cash Flows

- Pro Forma Financial Statements

- Depreciation

- Alternative definitions of OCF

Project Cash Flows

Capital Budgeting

- We learned how to evaluate projects given expected future cash flows. Where do these cash flows come from?

- Learn how to "spread the numbers"

- Work with financial statements to estimate FCF

- What info is relevant.

- Care about

changes in FCF

Relevant Cash flows

- You should always ask yourself "Will this cash flow occur ONLY if we accept the project?"

- If the answer is "yes," it should be included in the analysis because it is incremental

- If the answer is "no," it should not be included in the analysis because it will occur anyway

- If the answer is "part of it," then we should include the part that occurs because of the project

Stand-Alone Principle

- Can view incremental cash flows as "minifirm"

- Compare cash flows of minifirm to "cost of acquiring it"

Incremental Cash flows: Pitfalls

- Sunk Costs

- Opportunity Costs

- Side Effects

- Net Working Capital

- Financing Costs

Sunk Cost:Scenarios

- You just spent $1,000 on a ticket for a ski trip in Northern California, but soon after found a better ski trip in Colorado for $500 and bought a ticket for this trip too. You just found out the trip is the same weekend, which trip do you go on?

- Imagine you go see a movie which costs $10 for a ticket. When you open your wallet or purse you realize you've lost a $10 bill. Would you still buy a ticket?

- Now, imagine you go to see the movie and pay $10 for a ticket, but right before you hand it over to get inside you realize you've lost it. Would you go back and buy another ticket?

Sunk Cost

Sunk Cost: Examples

- The firm hires a consultant to evaluate their marketing campaign. Should you consider the cost in deciding to pursue the campaign?

- You have tickets to the Rams game on Sunday. At halftime it is 50-0 and raining and you are miserable. You are thinking of staying because "I've paid for the tickets"

- You are really hungry and order a 20 oz steak. Halfway through you are full and can't eat anymore. You try to push through because you already paid for it.

- I'm going to keep dating "Bob" because I've already invested so much time and effort into relationship.

- Basically any mobile game...

Opportunity Costs

- Do not confuse with sunk costs

- You own an abandoned factory that you purchased for a million dollars. You are thinking of converting it into hipster heaven with lofts and shops. What is the sunk cost? Opportunity cost? Is the factory "free"?

Side Effects: Erosion

- Benefits can be positive or negative.

- When Apple comes out with a new iphone it cannibalizes sales from existing iphone. Need to adjust expected future cash flows for decrease in sales.

- Adding a Starbucks to Target's store front. Consider increase in Target sales due to Starbucks.

- If I own two burger restaurants and decide to open a third location. Potential side effects?

Net Working Capital

- Early on you may "invest" in inventories, accounts receivable, accounts payable

- Firm supplies "the balance"

- As project winds down NWC recovered

- Resembles a loan

Financing Costs

- DO NOT include interest paid in analyzing proposed investment

- Or any other financing cost

- Financing costs are reflected in the discount rate.

Other Issues

- Use cash flows NOT accounting numbers. Occurs not accrues

- Always use

after tax cash flows

Pro Forma Financial Statements

Pro Forma

- Latin for "for the sake of form"

- Complex in real life

- Many ways to construct

- Most important and difficult part of capital budgeting

Steps

- Treat Project as mini-firm

- Determine project costs and returns: sales projections, fixed/variable costs, capital requirements

- Create Pro-forma balance sheet and income statement (NO INTEREST)

- Calculate project (mini-firm) cash flows (Bring back Chapter 2 skills)

- Tabulate total cash flows and value(Chapter 9 skills)

Example (from book)

- Sales: 50,000 cans of shark attractant per year, 4 dollars per can

- $2.50 per can to produce

- Product has a three year life

- Require 20% return

- FC 12,000/year

- 90,000 initial investment in manufacturing

- 100% depreciated over three-years (equal)

- 20,000 initial investment in NWC

- 34% tax rate

Projected Income Statement

| Sales (50,000 units at 4/unit) | 200,000 |

| Variable Costs (2.50/unit) | 125,000 |

| Fixed Costs | 12,000 |

| Depreciation (90,000/3) | 30,000 |

| EBIT | 33,000 |

| Taxes (34%) | 11,220 |

| Net Income | 21,780 |

Projected Capital Requirements (Balance Sheet)

| Year | ||||

|---|---|---|---|---|

| 0 | 1 | 2 | 3 | |

| Net Working Capital | 20,000 | 20,000 | 20,000 | 20,000 |

| Net Fixed Assets | 90,000 | 60,000 | 30,000 | 0 |

| Total Investment | 110,000 | 80,000 | 50,000 | 20,000 |

Notice: Book/Accounting Values NOT Cash Flows (Remember Chapter 2)

Projected Cash Flows

$OCF=EBIT+Depreciation$

$OCF= 33,000+30,000-11,220$

| Year | ||||

|---|---|---|---|---|

| 0 | 1 | 2 | 3 | |

| Operating Cash Flow | 51,780 | 51,780 | 51,780 | |

| Changes in NWC | -20,000 | +20,000 | ||

| Capital Spending | 90,000 | |||

| Total Cash Flow | -110,000 | 51,780 | 51,780 | 71,780 |

NPV @ 20% = 10,648 IRR =25.8%

More about Project Cash Flows

- Net Working Capital

- Depreciation (under old tax law)

Net Working Capital

General idea: Need to consider cash flows that aren't reflected on income statement.- Sales might be on credit

- Costs may not have been paid yet

- Cash flows have not yet occurred

- Important to consider in CF calculations

NWC: Example

| Sales | 500 |

| Costs | 310 |

| Net Income | 190 |

| Beginning of Year | End of Year | Change | |

|---|---|---|---|

| Accounts Receivable | 880 | 910 | +30 |

| Accounts Payable | 550 | 605 | 55 |

| Net Working Capital | 330 | 305 | -25 |

Total cash flow = 190-(-25)-0

Total cash flow = 215

NWC: Alternative View

What were cash revenues and costs for the year?| Change in Accounts Receivable shows 30 of sales have not been received yet | |||

| Sales | 500 | -30 | =470 |

| Change in Accounts Payable shows 55 of costs have not been paid yet | |||

| Costs | 310 | -55 | 255 |

Cash flow = Inflow - Outflow

Cash flow = 470 - 255 = 215

Depreciation

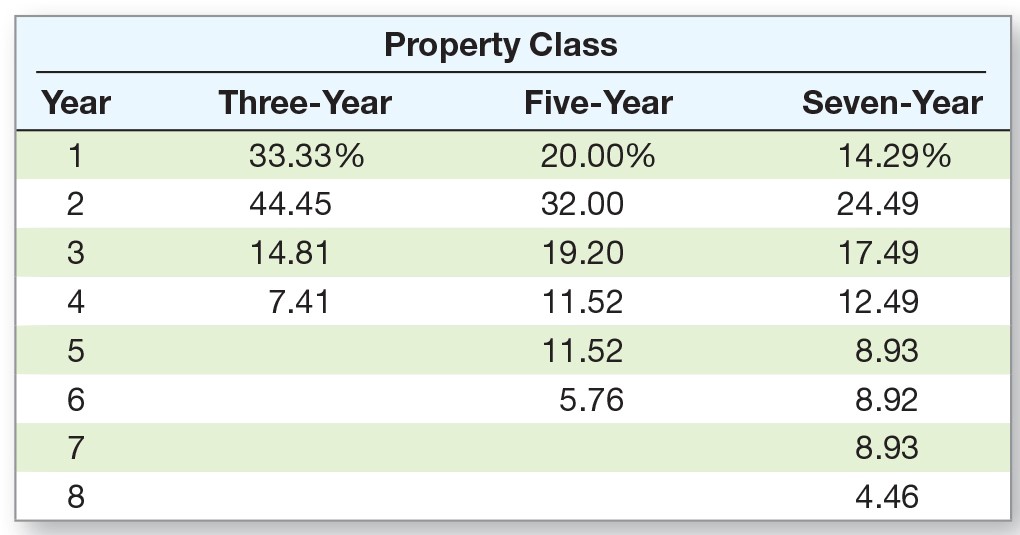

- MARCS: Modified Accelerated cost recovery system

- Asset class establishes"tax life"

- Table determined depreciation allowance by year

MARCS Table

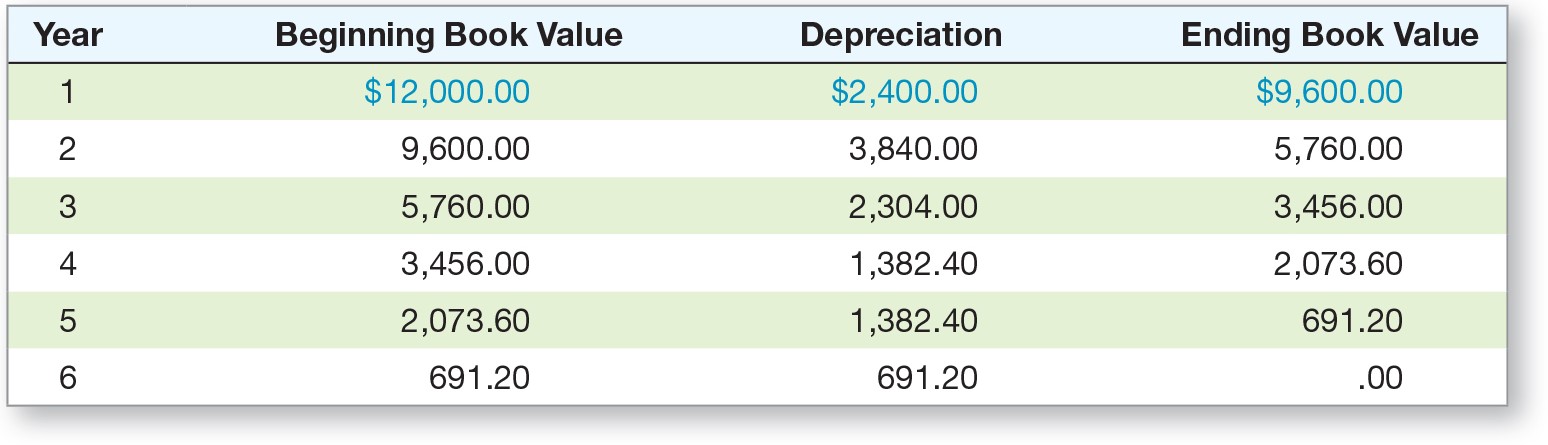

Depreciation: Example

What is the annual depreciation for a 12,000 asset in the five-year class.

Asset Sales

What if I sold the asset in the previous example for 3,000 in year 5?

3,000-691.21=2,308.80

2,308.80*0.34=784.99

After-tax Salvage value = Salvage value +/- Taxes from Salvage Value

After-tax Salvage value (cash flow) = 3,000-784.99

What if I sold the asset in the previous example for 500 in year 5?

500-691.21=-191.21

-191.21*0.34=-65.01

After-tax Salvage value = 500+65.01

Adjust for paying too much or too little in taxes.

Alternative OCF Definitions

- Bottom-up: OCF=Net Income+Depreciation

- Top-down: OCF=Sales-Costs-Taxes

- Tax Shield: OCF=(Sales-Costs)(1-T)+Depreciation*T

Alternative OCF: Example

Sales 1500;Costs 700; Depreciation 600EBIT=200; Taxes=68

OCF= 200+600-68=732

BU=132+600=732

TD=1500-700-68=732

TS=(1500-700)*(1-.34)+600*.34=732

Mega Example

Your company is thinking about a new product line. The product will sell for $120 per unit for the first 3 years and $110 per unit afterwards. Upfront NWC is $20,000, yearly NWC is 15% of sales. Variable costs are $60/unit and fixed costs are $25,000/year. New equipment will cost $800,000 and depreciate over seven-years following MACRS. Salvage value is 20% of cost. The tax rate is 34% and required return is 15 percent. Should you pursue this new product?| Projected Unit Sales | ||||||||

|---|---|---|---|---|---|---|---|---|

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Unit Sales | 3,000 | 5,000 | 6,000 | 6,500 | 6,000 | 5,000 | 4,000 | 3,000 |

Key Learning Outcomes

- Identify relevant/incremental cash flows and understand:

- Sunk costs

- Opportunity costs

- Side Effects

- NWC

- Financing Costs

- Calculate Pro Forma Financial Statements

- Estimate expected future cash flows

- Role of NWC

- Depreciation

- Alternative ways to calculate OCF