Introduction to Corporate Finance

Created by David Moore, PhD

Key Concepts

- Financial Management Decisions

- Business Organizations

- Goal of Financial Management

- Agency costs

- Flow of Cash

Corporate Finance

Answers- Decision: What

long-term investments should the firm choose? - Financing: How should the firm

raise funds for the selected investments? - Day-to-day: How should

current assets be managed by the firm?

Decision: Capital Budgeting

- Evaluate projects, cash flows, risk, etc.

- Make yes/no decision

- Create value for shareholders.

Financing: Capital Structure

- Long term financing.

- After deciding on project, How do you we finance (pay for) the projects/investments?

- Internal funds, debt, equity? Least expensive.

- Maximize shareholder value.

Day-to-Day: Working Capital Management

- Ensure the firm has sufficient resources and can avoid costly interruptions.

- How much cash/short-term assets do we need to hold? i.e., liquidity

- Inventory levels? Purchasing?

- Short-term financing?

Business forms

How you organize your business is important to:- Risks and liabilities

- Formalities and expenses

- Income taxes

- Investment capabilities

Forms of Business Organization

- Sole proprietorship: A business owned by a

single individual. - Partnership: A business formed by

two or more individual entities. - Corporation: A business created as a

distinct legal entity.

Business Forms: Pros and Cons

| Forms | Pros | Cons |

|---|---|---|

| Sole proprietorship | Least Regulated, most common, pass-through taxation, easy to set up. | Unlimited liability, limited to life of owner, Equity limited to owner, difficult to transfer ownership. |

| Partnership | More capital, easy to start, pass-through taxation. | Unlimited liability, partnership dissolves with death or sale, difficult to transfer ownership. |

| Corporation | Limited liability, Unlimited life, Separation of ownership and management (can be a con), easier to transfer ownership and raise capital. | Double Taxation, increased regulation |

Notes on Partnerships

Joint Authority: Any partner can bind the other(s) to agreements.

Joint Liability: Anyone can be sued.

Two types:

General: All partners share in management and liability.

Limited: Limited partners provide capital and receive profits (reduced liability and little to no management)

(Un)Limited Liability

Lester is the owner of a small manufacturing business. When business prospects look good, he orders $50,000 worth of supplies and uses them in creating merchandise. Unfortunately, there's a sudden drop in demand for his products, and Lester can't sell the items he has produced. When the company that sold Lester the supplies demands payment, he can't pay the bill.

(Un)Limited Liability

Shirley and Sue are the owners of a flower shop. One day Roger, one of the employees, is delivering flowers using a truck owned by the business. Roger strikes and seriously injures a pedestrian. The injured pedestrian sues Roger, claiming that he drove carelessly and caused the accident. The lawsuit names Shirley and Sue as co-defendants. After a trial, the jury returns a large verdict against Shirley and Sue as owners of the business.

Corporation

- Legal entity.

- Largest in USA in terms of size.

- Half of US employment.

- Class will focus on corporations.

- Think: Apple, Netflix, Facebook, GM, Proctor and Gamble.

Terms

| Articles of incorporation or Charter | Name, business purpose, headquarters, shares issued, board of directors. Content varies by state. Legally document creation of a corporation. ex. Amazon: "to engage in any lawful act or activity for which corporations may be organized under the General Corporation Law of Delaware" |

| Bylaws | “set of rules” on how corporation to be run. ex. How are board members elected? How are meetings conducted? |

Types of Corporations

| Limited Liability Company (LLC) | Hybrid of partnership and corporation: Operate and taxed like a partnership, retain limited liability. Must remain un-corporate-like in eyes of IRS to avoid double taxation. Start an LLC |

| S-corp | Pay taxes like partnership. Some rules: US citizen, Max 100 shareholders, Gains and losses must equal share in company. |

| C-corp | Typical corporation. |

Financial Management

Goal of Financial Manager

Agency Problems

- Principal hires agent to represent his/her interests.

- Problem comes from conflicts of interest.

Real Estate Example

Another Example

The manager is considering a new investment. This investment will add to firm value(positive NPV) but is relatively risky. Shareholders would benefit from this project.

What is the agency cost here?

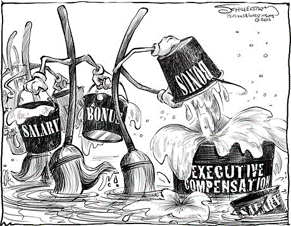

Agency Costs

- Direct: Poor spending by management, empire building, monitoring costs

- Indirect: Avoidance of justified risky projects.

Aligning Interests: Compensation

Aligning Interests: Control of firm and Board of Directors

Aligning Interests: Monitoring

Flow of Cash

Key Learning Outcomes

- Three main areas of concern for financial manager

- Goal is to maximize shareholder wealth

- Business forms (advantages and disadvantages)

- Agency problems and solutions

- Flow of Cash