Financial Statement Analysis

Created by David Moore, PhD

Reference Material: Wall Street Prep Accounting Crash Course (Chapter 51)Key Concepts

- Common-size Financial Statements

- Vertical vs Horizontal

- Financial Ratios

- Dupont Identity

- Benchmarking

- Issues with analyzing financial statements

What Is Financial Statement Analysis?

- External: Understand overall health

- Internal: Monitoring tool

General Issue

How do we compare Financial Statements?- Size is a major issue

- Solution

- Standardize financial statements

- Vertical

- Horizontal

- Financial Ratios

Common-Size Statements

- Balance Sheet

- Vertical:Express as a percent of total assets

- Horizontal:Express as a percent of base or last year

- Income Statement

- Vertical:Express as a percent of Sales

- Horizontal:Express as a percent of base or last year

- Vertical: Within same period for the same company

- Horizontal:Across reporting periods (base-year or growth)

Common Size Balance Sheet

Vertical Analysis

| 2017 | 2018 | Common-Size | |

|---|---|---|---|

| Cash | 84 | 146 | 146/3636=4.0% |

| A/R | 165 | 188 | 188/3636=5.2% |

| Inventory | 393 | 422 | 422/3636=11.6% |

| PPE | 2731 | 2880 | 2880/3636=79.2% |

| Total Assets | 3373 | 3636 | 3636/3636=100% |

Common Size Balance Sheet

Horizontal Analysis

| 2017 | 2018 | Common-Size | |

|---|---|---|---|

| Cash | 84 | 146 | 146/84-1=73.8% |

| A/R | 165 | 188 | 188/165-1=13.9% |

| Inventory | 393 | 422 | 422/393-1=7.4% |

| PPE | 2731 | 2880 | 2880/2731-1=5.5% |

| Total Assets | 3373 | 3636 | 3636/3373-1=7.8% |

Common Size Income Statement

Vertical Analysis

| 2018 | Common-Size | |

|---|---|---|

| Sales | 2311 | 2311/2311=100.0% |

| Cost of Goods Sold | 1344 | 1344/2311=58.2% |

| Depreciation | 276 | 276/2311=11.9% |

| EBIT | 691 | 691/2311=29.9% |

| Net Interest Expense | 141 | 141/2311=6.1% |

| Taxable Income | 550 | 550/2311=23.8% |

| Taxes | 116 | 116/2311=5.0% |

| Net Income | 435 | 435/2311=18.8% |

What the Common-Size Reveals

- Large or drastic changes

- Strategy

- Used as part of Overall Financial statement analysis

Caveats

- Quarterly Data and Horizontal

- Use same fiscal quarter

- Horizontal can be misleading due to base year selection

- Best if Vertical and horizontal are used in conjunction.

- Can also compare intra-industry

Ratio Analysis

Overview

- Why study ratios?

- There are a lot of financial ratios; CFA exam has 40!

- We will cover commonly used ratios

- Not all ratios created from same data, i.e., be careful!

Takeaway: It is trivial to calculate ratios, I want you to

Ask Yourself

- How is the ratio computed?

- What is the ratio trying to measure and why?

- What is the unit of measurement?

- Does the sign make sense?

- What does the value indicate?

- How can we improve the company's ratio?

Ratio Types

- Liquidity or Short-term solvency

- Asset Management or Turnover

- Financial leverage or Long-term Solvency

- Performance

- Profitability

- Market Value

Click here for a full list and description of financial ratios.

Short-term solvency

$Current Ratio=\frac{Current Assets}{Current Liabilities}$

$Quick Ratio=\frac{Current Assets - Inventory}{Current Liabilities}$

$Cash Ratio=\frac{Cash}{Current Liabilities}$

$Interval Measure=\frac{CA}{Average Daily Operating Costs}$

This is just a sample of ratios for this category

Asset Management

$Inventory Turnover=\frac{Cost of Goods Sold}{Inventory}$

$Days' Sales In Inventory=\frac{365 days}{Inventory Turnover}$

This is just a sample of ratios for this category

Long-term Solvency

$Total Debt Ratio=\frac{Total Assets - Total Equity}{Total Assets}$

$Debt\text{-}Equity Ratio=\frac{Total Debt}{Total Equity}$

$Equity Multiplier=\frac{Total Assets}{Total Equity}$

$Cash Coverage Ratio=\frac{EBIT + Depreciation}{Interest}$

Sidenote: Typically analysts are only concerned with long-term debt.

This is just a sample of ratios for this category

Performance: Profitability

$Profit Margin=\frac{Net Income}{Sales}$

$Return on Equity(ROE)=\frac{Net Income}{Total Equity}$

$Return on Assets(ROA)=\frac{Net Income}{Total Assets}$

This is just a sample of ratios for this category

Performance: Market

$Earnings Per Share=\frac{Net Income}{Shares Outstanding}$

$PE Ratio=\frac{Price Per Share}{Earnings Per Share}$

$Market\text{-}To\text{-}Book Ratio=\frac{Market Value}{Book Value}$

This is just a sample of ratios for this category

Enterprise value

$Enterprise Value=Market Cap + Book Value Of Liabilities - Cash$

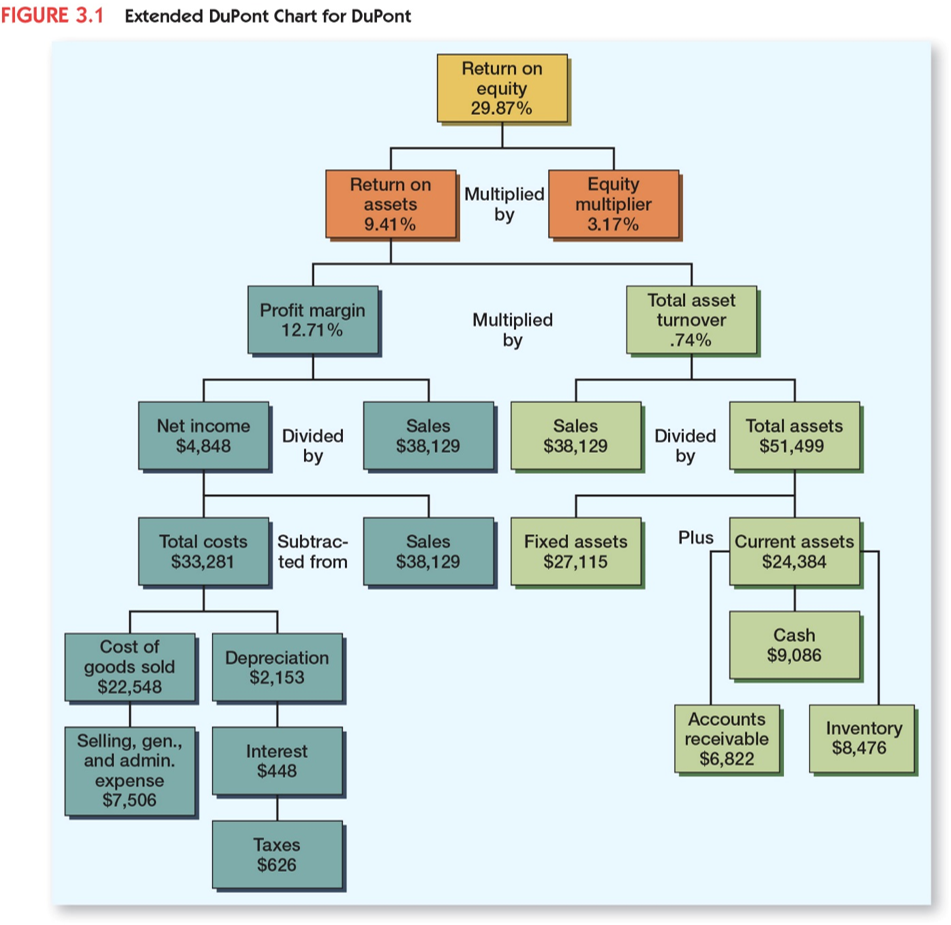

Dupont Identity

$ROE=Profit Margin \text{ x } Total Asset Turnover \text{ x } Equity Multiplier$

Why analyze financial statements?

- Market data can be difficult to get

- Comparison tool: Internal vs external uses

Benchmarking

Ratio in isolation does not paint entire picture, therefore; compare to "something". Benchmarking is finding that something.

Common Benchmarks

- Time trend analysis (Horizontal)

- Peer group analysis (Vertical/Intra Industry)

SIC Codes

Issues/Concern with Financial Statements Analysis

- No theory

- Conglomerates

- Globalization

- Different accounting procedures

- Fiscal-year ends and seasonality

- One-time events

Financial Statement Analysis in practice

Ratios Tell A Story

California Choppers Case

Key Learning Outcomes

- Common-size: vertical vs horizontal

- Financial Ratios!!! Calculate and

interpret. - Dupont Identity

- Benchmarking

- Issues with analysis